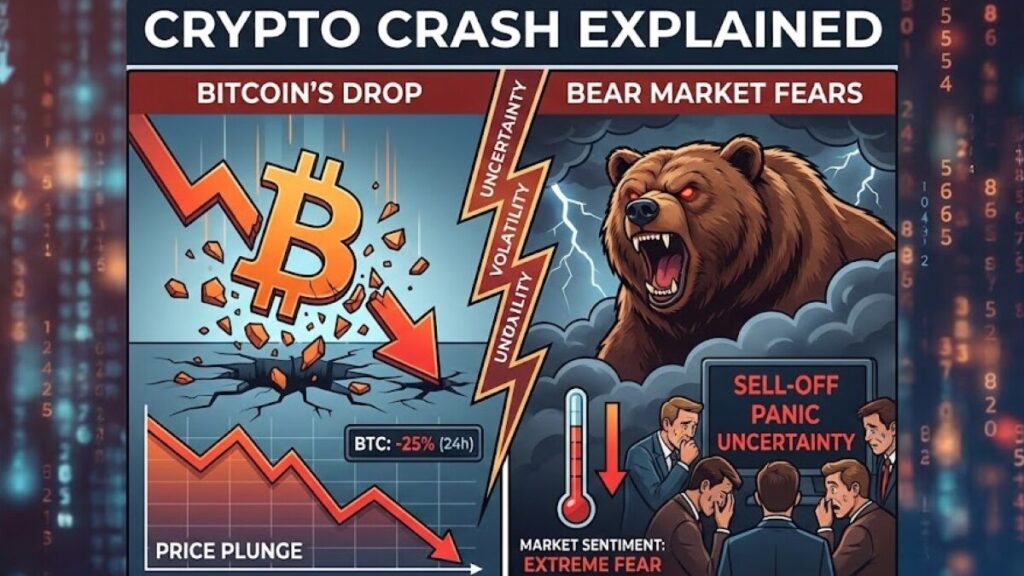

An analyst on X explained today that Bitcoin’s recent sharp decline is driven by a combination of technical failures, stablecoin volatility, and macroeconomic pressures. The post highlights that the October 10 sell-off triggered cascading liquidations across leveraged positions.

Woaow! Explosive Interview with Tom Lee on CNBC

1. He admitted a “glitch” is responsible for selloff in the crypto world

2. He said $BTC might hit $77k

3. $ETH might hit $2500

4. $MSTR has hit lowest at current prices

5. Crypto will rebound faster than the decline.I enjoy… pic.twitter.com/DDcuzqVO0Y

— TheInvestIQ 🇳🇬 🇨🇦 (@uzyrebranded) November 21, 2025

The rapid market movement affected retail and institutional traders alike, as automated trading systems amplified downward momentum. According to the analyst, a bug in a stablecoin briefly caused it to lose its peg, which contributed to forced liquidations and heightened volatility. The sudden sell-off coincided with broader macroeconomic challenges, including rising interest rates and a stronger U.S. dollar, putting additional stress on crypto valuations. These factors combined have raised concerns that Bitcoin may be entering a more prolonged bear market, rather than experiencing a short-term correction.

Investors and market watchers will be monitoring key support levels and liquidity indicators over the coming days to gauge whether the downturn will deepen or stabilize. Analysts suggest paying close attention to technical signals, including moving averages and RSI, as well as macroeconomic developments that could influence the market. While short-term rebounds remain possible, the analyst cautions that sustained recovery will depend on a stabilization of both technical and macro factors.

Source: Uzoma Ogwuma on X.

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.