TL;DR

- Risk-off sentiment and Fed rate cuts delay triggered a sharp decline.

- Massive liquidations and ETF outflows accelerated Bitcoin’s downward price movement.

- Analysts see a mid-cycle pullback, not a structural market collapse.

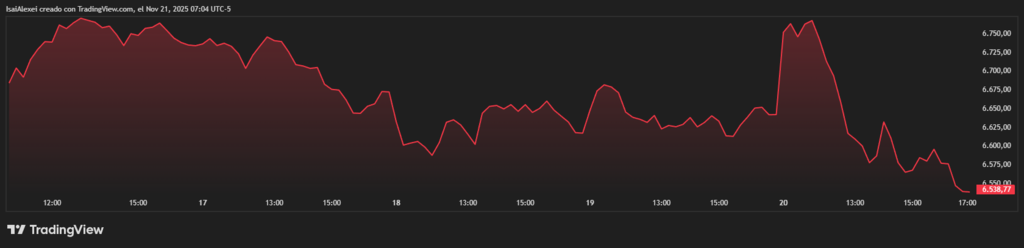

Bitcoin drops sharply today, falling 8–10% in the past 24 hours and trading below $84,000, its lowest level since April. The price now stands more than 30% under the $126,000 peak from October and removes over $1.5 trillion from the total crypto market value.

The decline reflects risk-off sentiment, pressure from traditional markets, and a liquidation wave triggered by excessive leverage.

Global markets show strong risk aversion

The S&P 500 loses about $1.5 trillion from its intraday high, and the Nasdaq drops 4–8% due to concerns about AI-related spending and the correction in tech stocks. That downturn drags crypto, as Bitcoin maintains broad correlation with risk assets.

Stronger-than-expected U.S. labor data reduce expectations of a Federal Reserve rate cut. Markets now price a 30–40% chance of a December cut, tightening liquidity and pressuring volatile assets such as BTC.

Bitcoin ETFs in the U.S. register more than $2.5 billion in outflows in November. Continuous selling from institutional products increases supply and accelerates intraday declines.

A cascade of mass liquidations deepens the drawdown. Exchanges close more than $1–2 billion in leveraged positions within 24 hours, driven by whale selling, short-term capitulation, and thin liquidity.

Geopolitical tension also weighs on markets. Trump-era tariff measures, Japan’s $135 billion stimulus, yen carry-trade unwinding, and rising Japanese bond yields add volatility. At the same time, high energy costs linked to AI demand push miners to sell BTC and shift toward AI-hosting activities.

Technically, Bitcoin breaks key support levels such as $90,000 and $84,000. The death cross and an extreme oversold RSI indicate room for a relief bounce, although declining BTC dominance affects altcoins.

Mass Liquidation Event Across the Market

Data from Coinglass show 391,164 traders liquidated in the past 24 hours, totaling $1.91 billion. Longs account for $1.78 billion, while shorts add $129.3 million. The largest single liquidation hits Hyperliquid, where a BTC-USD long worth $36.78 million gets closed.

#PeckShieldAlert Following $ETH's drop below $2,900, a whale (0x3ee3…42a6) was liquidated on their long $wstETH position.

The position, which involved borrowing $USDC against $wstETH collateral, saw a total liquidation of $6.52M. pic.twitter.com/mv30VuXFfn

— PeckShieldAlert (@PeckShieldAlert) November 21, 2025

Bitcoin leads liquidations with $960 million, including $929 million from leveraged longs. Ethereum follows with $403.15 million, mostly long positions. On-chain monitors track heavy whale losses as ETH falls under $2,900. Liquidations range from $2.9 million to $6.52 million.

The trader known as Machi now holds only $15,538, after losses exceeding $20 million. The “Anti-CZ Whale” also reports steep drawdowns caused by aggressive long exposure in ETH and XRP. That account faces new liquidations today.

Total crypto market capitalization falls more than 6% to $2.9 trillion. According to The Kobeissi Letter, the market erases over $1.3 trillion since early October.

The report describes a “mechanical bear market” shaped by heavy leverage and rapid liquidation cycles that create a feedback loop of forced selling.

Analysts label the move a mid-cycle pullback rather than a structural collapse. The Fear & Greed Index sits at 11–15, reflecting extreme fear—a zone often associated with rebound potential.

Key support levels appear between $78,000 and $85,000, with projected short-term targets near $98,000–$102,000 if liquidity stabilizes.