TL;DR

- The former Mt. Gox platform moved 10,608 BTC worth $953M from an inactive wallet, its only transfer since March.

- The administrator postponed repayments until October 2026, keeping nearly $4B out of the market.

- The new 1ANkD address received and is holding the 10,608 BTC.

Mt. Gox reactivated one of its inactive wallets and moved 10,608 BTC worth $953M, a volume it had not registered since March.

The transfer triggered immediate debate around the bankruptcy administrator’s strategy, as repayments to creditors were pushed back again to October 31, 2026. The delay keeps about $4B in Bitcoin out of the market for another year and lowers the risk of a sudden liquidation, a point still being evaluated by companies, funds, and institutional traders who have been absorbing supply since 2024.

The Mt. Gox wallet had not moved more than $1M since sending 893 BTC at the end of March. The current operation sent the 10,608 BTC to a new address known as 1ANkD, which has not forwarded funds to exchanges or shown typical signs of a sell-off in preparation. The inactivity of the new address cast doubt on the market’s more aggressive interpretation, which anticipated a potential liquidation process.

Mt. Gox’s Decisions No Longer Carry the Same Weight in the Market

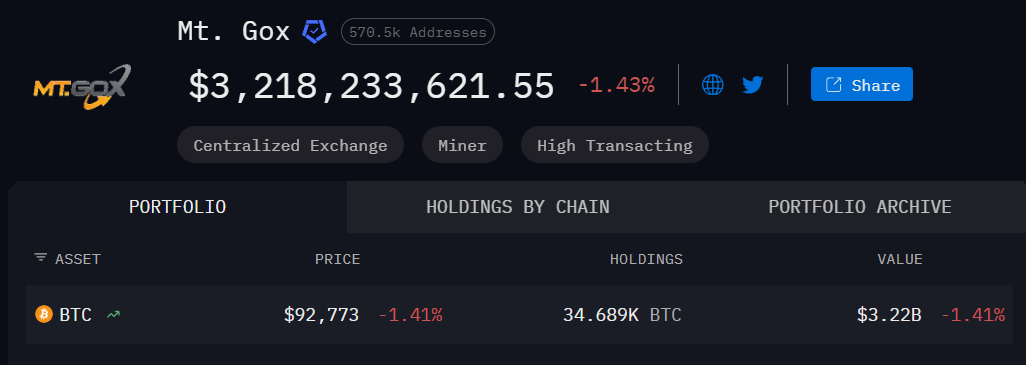

Mt. Gox still holds 34,689 BTC valued at around $3.14B, a substantial figure but one that is increasingly less influential for market balance. The steady flow of institutional capital through spot ETFs, corporate treasuries, and large-scale investment vehicles reshaped the dynamic that once amplified any news related to the former exchange. Since the first repayment wave in July 2024, Bitcoin’s price has climbed from $56,160 to over $91,000, a move that demonstrated the market’s ability to absorb released supply throughout the year.

The administrator overseeing the bankruptcy process justified the new extension by pointing to incomplete procedures among certain creditors. For part of the ecosystem, the delay adds stability and limits volatility driven by uncertainty. For others, the $953M transfer only revives questions about the true purpose of the transaction and the internal coordination of a bankruptcy process that has dragged on for more than a decade with repeated timeline changes.

Mt. Gox, which once processed over 70% of global BTC volume in 2013, remains a recurring source of potential risk due to the size of its reserves. Even so, the latest reaction shows a market that is broader, more liquid, and less dependent on a company that no longer operates