TL;DR

- ARK Invest purchased $10.2 million in Bullish stock during a major market downturn.

- Bullish shares hit a new record low, falling nearly half their value.

- The entire crypto stock sector experienced a sharp and widespread decline Monday.

Cathie Wood’s ARK Invest made a significant purchase of Bullish stock on Monday, committing $10.2 million to the crypto exchange as its shares fell to a new all-time low. This occurred during a widespread rout that hammered publicly-traded companies across the crypto asset sector.

ARK’s daily trade disclosure revealed the firm bought heavily into the declining asset. The flagship ARK Innovation ETF (ARKK) added 191,195 Bullish shares. Furthermore, the ARK Next Generation Internet ETF (ARKW) purchased 56,660 shares, and the ARK Fintech Innovation ETF (ARKF) acquired another 29,208. This buying spree pushed ARK’s total investment in Bullish for the day past the $10 million mark.

The acquisition coincides with a prolonged slump for the exchange. Bullish stock dropped 4.5% to close at $36.75 on Monday. This price extends a months-long decline, resulting in a nearly 46% loss for shareholders over the past six months. The timing of ARK’s investment is particularly notable, as it comes just one day before Bullish is scheduled to release its third-quarter earnings report.

The exchange, which counts billionaire Peter Thiel as a key backer, had a mixed financial performance in the previous quarter. It posted $57 million in adjusted revenue for the second quarter, down from $67 million a year earlier. However, the company swung dramatically to a net income of $108.3 million, a stark reversal from the $116.4 million loss it reported for the same period last year.

Broad Sell-Off Grips Crypto Equity Market

The pressure on Bullish reflects a broader crisis of confidence affecting crypto-linked stocks. Mining companies and infrastructure firms absorbed some of the heaviest losses. Marathon Digital saw its shares fall 4%, continuing a steady decline from the previous week. Similarly, competitors Riot Platforms and CleanSpark also finished the trading day in negative territory.

The downturn was not confined to miners. Strategy, dropped 2% yesterday. Its stock has now fallen more than 18% over the past five consecutive trading sessions. Meanwhile, stablecoin issuer Circle, which became a public company earlier this year, ended the day down more than 6%. Circle has plummeted over 26% in the last week.

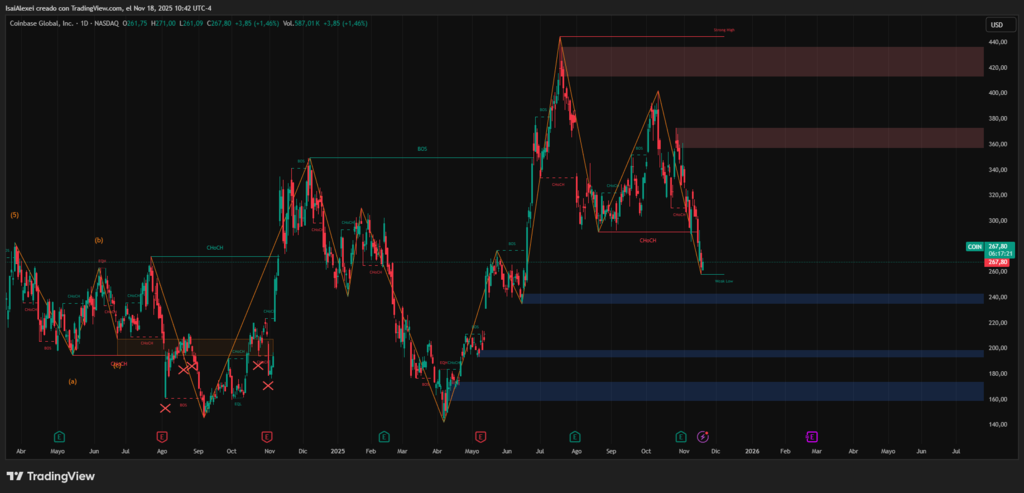

Even the largest U.S. crypto platform faced intense selling pressure. Coinbase closed down 7% at $263.95 after sliding steadily throughout the session. This decline mirrored a broader retreat from risk-sensitive assets across financial markets.

Analysts point to a combination of factors driving the sell-off

Lingering anxiety from a major liquidation event on October 10th and growing uncertainty about a potential Federal Reserve rate cut in December are creating a cautious environment. Consequently, investors are pulling capital from the volatile sector. Despite the negative momentum, some market observers see a potential buying opportunity in the current prices. Matt Hougan of Bitwise Asset Management described the price range as a potential “generational opportunity” for investors with a long-term perspective.