TL;DR

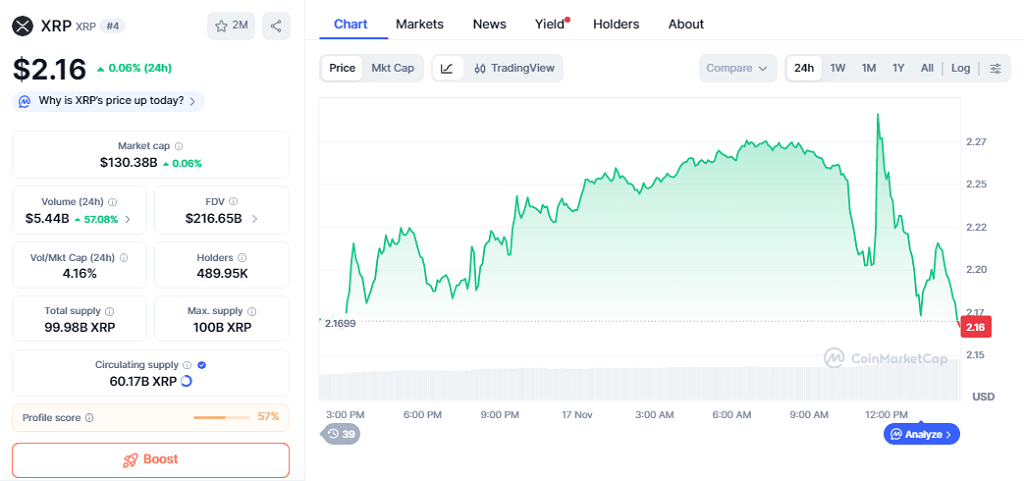

- XRP is currently trading at $2.16 with a market capitalization of $130.38 billion, showing a 0.06% gain in the last 24 hours.

- Major financial institutions, including Franklin Templeton, Grayscale, and ProShares, are preparing XRP-linked ETFs in the US.

- Analysts predict that XRP could rise 21% in the coming weeks, fueled by institutional ETF inflows and momentum around cross-border payments and stablecoin initiatives.

XRP is gaining renewed attention from institutional investors as Franklin Templeton and other major financial firms move into the US ETF market. Experts anticipate a significant price increase in the coming weeks as spot XRP ETFs attract more capital. The upcoming ETF launches are expected to provide more regulated access for US investors, potentially increasing trading volumes and liquidity across exchanges.

ETF Launches Set To Boost XRP Price

Canary Capital’s first spot XRP ETF debuted on November 13, raising $250 million on its first trading day with nearly $60 million in volume. At the same time, US spot Bitcoin ETFs lost $866 million and Ethereum products declined by $260 million, highlighting a shift in institutional investment focus toward XRP. Ryan Lee, chief analyst at Bitget, projects XRP could rise 21% to reach $2.75 due to cross-border liquidity flows and growing stablecoin activity. Polymarket data assigns a 36% probability that XRP will hit $2.60 in November. Analysts also note that increased interest from hedge funds and asset managers could amplify momentum in secondary markets.

Major Financial Players Preparing XRP ETFs

The Depository Trust and Clearing Company lists a dozen XRP spot funds in its pipeline, indicating imminent launches. Franklin Templeton, with $1.5 trillion in assets under management, will introduce an XRP-linked ETF alongside its Bitcoin, Ethereum, and crypto index products. ProShares, known for the first US Bitcoin futures ETF, is preparing UXRP, expanding institutional exposure to XRP.

Grayscale, recognized for its Bitcoin Trust and SEC court victory, is also entering the XRP ETF market. Many of these firms are collaborating with large custodian banks to streamline settlement and compliance processes. Together, these efforts could bring billions in inflows and strengthen XRP’s role in the US crypto market.

Institutional Interest Signals Growth Opportunity

With Wall Street increasing XRP ETF offerings, the token’s current price of $2.16 and market cap of $130.38 billion suggests strong potential for institutional-driven growth. November’s ETF wave could push XRP toward or above its July all-time high of $3.65, positioning it as a leading candidate in the next phase of the crypto market’s expansion.