TL;DR

- Bitcoin slips below $95K as uncertainty around US monetary policy accelerates risk reduction across global markets.

- Institutional flows remain negative, with ETF outflows above $3B signaling rotation rather than structural weakness.

- Despite short-term pressure, pro-crypto analysts emphasize that the broader trend remains supported by strong fundamentals and sustained long-term accumulation.

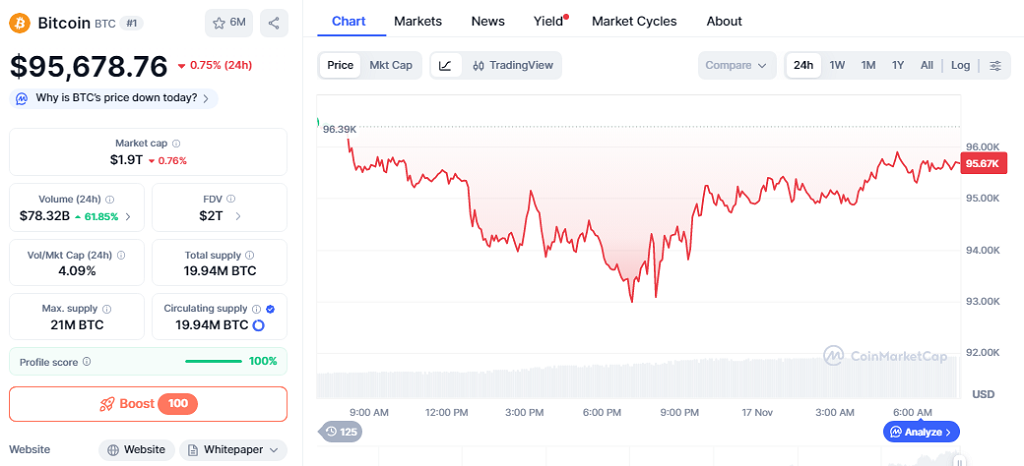

Bitcoin retreats toward the $94K area after a decline that pushed the asset to a recent low. Ambiguous signals from the Federal Reserve and renewed selling in institutional products keep downward pressure in place. Bitcoin trades at $95,678.76, with a -0.75% performance in the past twenty-four hours, a market cap of $1.9T, and volume at $78.32B, rising 61%.

Fed Jitters Shape The Risk Tone

Position trimming accelerates as traders curb exposure to volatile assets. The absence of a full set of US economic indicators, following weeks of delays in key releases, reinforces caution. Derivatives desks report heavier hedging as the institution maintains a restrictive stance. Analysts argue that the recent decline stems from macro pressure rather than weakening crypto fundamentals. Several fund managers mention that liquidity fragmentation across major exchanges slightly amplifies short-term swings but does not alter their broader allocation frameworks.

Meanwhile, ETF outflows surpass $3B since late October, highlighting a portfolio reshuffle instead of a broad abandonment of the asset. Trading desks note that selling pressure has eased slightly, with tactical buyers stepping in to capture short rebounds as liquidity remains healthy.

Bitcoin Market Dynamics Remain Resilient

Developers, validators, and institutional actors keep a constructive outlook. Network activity stays elevated and open interest in futures remains steady, preventing any disorderly liquidation. Market specialists point out that similar pullbacks have appeared in previous cycles, and Bitcoin often regains momentum once macro signals stabilize. Some analysts add that on-chain accumulation by long-term holders continues at a pace consistent with prior expansion phases.

The surge in trading volume indicates rebalancing rather than forced selling. Long-term oriented traders continue accumulating within intermediate ranges, taking advantage of corrections in a market that has shown strong structural support throughout the year.

In conclusion, the drop under $95K attracts attention, but seasoned traders view the current setup as consistent with a resilient market supported by adoption and sustained capital flows. Focus now shifts to upcoming central bank communication and institutional activity to evaluate whether this move is a temporary adjustment or an opportunity to reposition.