TL;DR

- Anchorage Digital executed a $405M BTC purchase at the most intense point of the pullback, taking advantage of the emotional pressure building on retail traders.

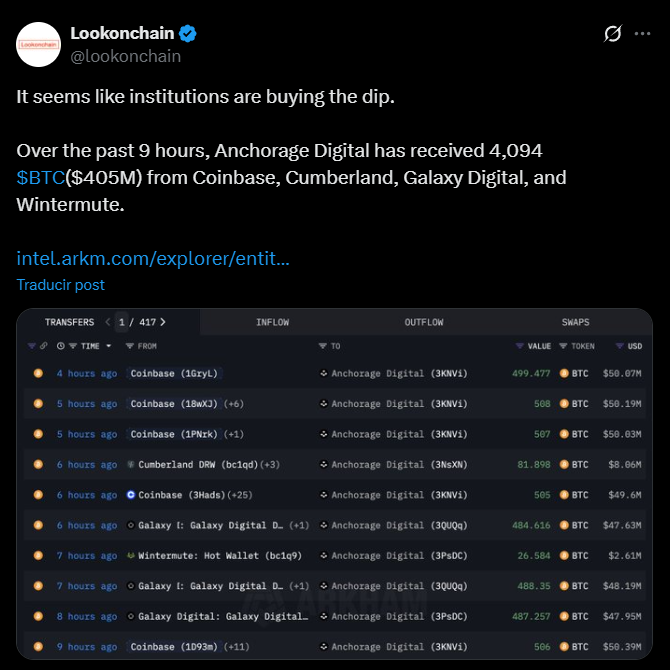

- Anchorage added 4,094 BTC from institutional desks and confirmed that professional capital advances when BTC’s price slides into the $97K–$94K range.

- Data shows that roughly 355 entities are accumulating BTC, while on-chain signals point to new liquidity inflows and a widening gap between institutions and retail.

Anchorage Digital triggered a $405M Bitcoin purchase at the most stressful moment of the correction, right as retail markets assumed the drop would break the year’s bullish structure.

Anchorage acquired 4,094 BTC from Coinbase, Cumberland and Wintermute, reinforcing a pattern that appears in every deep pullback: institutional capital presses forward when short-term sentiment fractures. BTC hit a six-month low and the Fear & Greed Index fell to 22, a reading that captures the emotional strain driving retail behavior.

Volatility carved out a technical validation zone between $97K and $94K. That range includes a CME gap near $92K that many traders treat as a point where liquidity often settles. Analysts such as Ali Martinez note that the $95.9K and $82K levels outline the structure of the cycle. Losing both could open a path toward $66K. This cluster of signals accelerated retail selling and strengthened the idea that the market entered a deeper corrective phase.

Anchorage and More Than 300 Firms Keep Accumulating Bitcoin

Meanwhile, data shows a contrasting behavior among institutions. BitcoinTreasuries identifies 355 organizations that already hold BTC as part of their treasury management, with a combined total of 4.05 million BTC under institutional control. The trend is also expanding within governments. Luxembourg allocated 1% of its sovereign wealth fund, about €7 million, to Bitcoin. The Czech National Bank is preparing an experimental digital-asset portfolio centered on BTC. These flows reflect a medium-term view that does not depend on short-term volatility.

The thesis behind this accumulation leans on a possible expansion of liquidity following the reopening of the U.S. government and on expectations of measures that could ease monetary conditions.

On-chain firms such as Santiment have highlighted signs of rotation out of gold and into Bitcoin, along with a level of retail capitulation that historically signals entry windows for professional managers. The market now operates at two speeds: one shaped by fear, and another driven by a methodical accumulation strategy. The result is a widening gap that continues to define the character of the current cycle