TL;DR

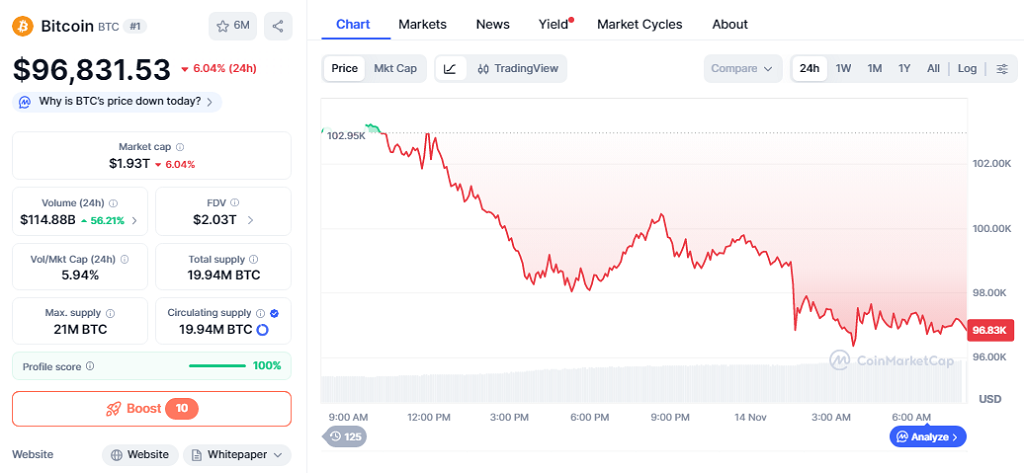

- Bitcoin drops to $96,831.5 after a 6.04% decline, with trading volume rising 56% to $144.88 B as volatility intensifies.

- Its market cap remains at $1.93 T, showing continued participation from long-term holders.

- Traders focus on Federal Reserve guidance, which heavily influences short-term sentiment across digital assets.

Bitcoin moves below $100,000 during a session marked by heavier selling and rising volatility. The downturn aligns with broader market adjustments as investors wait for clearer signals from the Federal Reserve.

Bitcoin Market Adjusts To Federal Reserve Expectations

Bitcoin’s slide toward $96,831.5 reflects a wider correction that accelerates as hopes for immediate monetary easing diminish. The 6.04% daily loss pairs with a strong rise in trading volume to $144.88 B, showing that market participants are actively repositioning. Its market cap near $1.93 T demonstrates that the asset keeps a robust investor base despite the price pressure.

Tech-heavy equity indices also weaken, increasing the visibility of correlation between crypto and other risk assets.

Analysts point out that Bitcoin maintains strong engagement during stress episodes. Ethereum, Solana and other leading tokens record similar declines, though within ranges seen over the past weeks.

Additional market data shows that liquidity across major exchanges remains stable, allowing larger orders to be executed without severe slippage. Funding rates on perpetual futures lean slightly negative, a signal that short-term sentiment softens but without indications of structural deterioration. Several trading desks report that OTC activity increases as institutional buyers explore opportunities to accumulate during periods of temporary weakness.

Federal Reserve Signals Shape Crypto Sentiment

Traders monitor recent statements from central bank officials, who adopt a cautious tone on future rate adjustments. The absence of a complete labor-market report adds uncertainty and slows aggressive market positioning.

Derivatives platforms show a balanced mix of long and short contracts, hinting that some investors expect a rebound if the Federal Reserve offers clearer policy direction. On-chain data shows increased activity among large BTC holders, a pattern often linked to accumulation zones. These movements suggest that long-term strategies remain in place, reinforcing the thesis of structural confidence in the asset.

Bitcoin trades under pressure, yet the surge in volume and the behavior of long-term investors point toward a resilient market structure. Upcoming comments from the Federal Reserve may define the short-term tone, while digital assets continue to show firm engagement even in sessions dominated by heightened volatility and broader macro sensitivity.