TL;DR

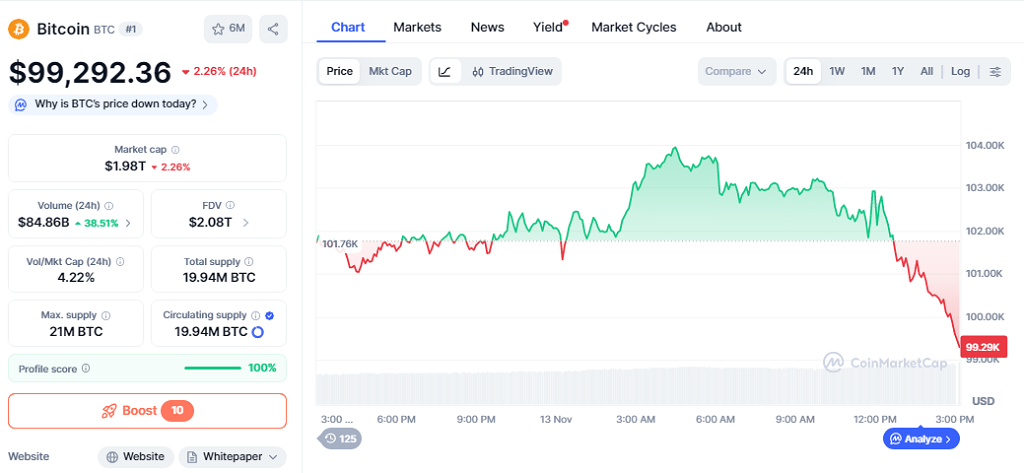

- Bitcoin (BTC) recently slipped below the $100,000 mark amid evaporating liquidity, now trading at $99,292.36.

- The market saw a -2.26% decline over the past 24 hours with a 24‑hour trading volume surge to $84.86B (+38%), highlighting increased short-term activity.

- With a market cap of $1.98T, BTC is increasingly influenced by macroeconomic conditions, including U.S. liquidity shifts, rather than isolated crypto momentum.

Bitcoin (BTC) has fallen below the $100,000 support level, currently trading at $99,292.36, as liquidity in crypto markets tightens. The past 24 hours have seen a -2.26% drop while trading volumes surged 38% to $84.86B, reflecting high activity amid uncertainty. This decline illustrates the growing influence of broader market conditions on BTC’s performance. Traders are reacting quickly, with both retail and institutional participants adjusting positions in response to recent volatility.

Market Structure And The $100,000 Threshold

The breakdown through the $100,000 level marks a significant moment for BTC. Earlier, prices had bounced near $104,000, but a pullback during U.S. market hours pushed BTC to $99,292.36. Spot ETF outflows and reduced institutional bids have removed stabilizing support, increasing volatility. With a market cap of $1.98T, Bitcoin remains the largest crypto asset, yet it is showing sensitivity to macro liquidity constraints rather than just market sentiment. Analysts note that technical levels around $100,000 are being watched closely by traders, potentially defining short-term support zones.

Liquidity Drain And Macro Triggers

Liquidity pressures have intensified due to U.S. Treasury balances and restrained market funding. Analysts note that Bitcoin is now highly correlated with liquidity and macro flows; tightening financial conditions amplify BTC’s short-term swings. The surge in 24-hour volume to $84.86B (+38%) indicates that traders are actively responding to these shifts, with both buying and selling pressure impacting price direction. Market participants are also paying attention to upcoming macroeconomic releases.

Implications For Bitcoin Investors

Although short-term trading looks challenging, some strategists suggest this liquidity-driven correction could strengthen the market foundation. Periods of high volume with declining price often precede steadier gains once liquidity normalizes. Long-term accumulation continues quietly, suggesting BTC could rebound when broader conditions improve. Investors are advised to monitor both on-chain activity and macro indicators to better gauge potential entry points.

Bitcoin slipping under $100,000 with current data showing $99,292.36, -2.26% 24h decline, $1.98T market cap, and $84.86B trading volume reflects a market now dominated by liquidity and macro factors.