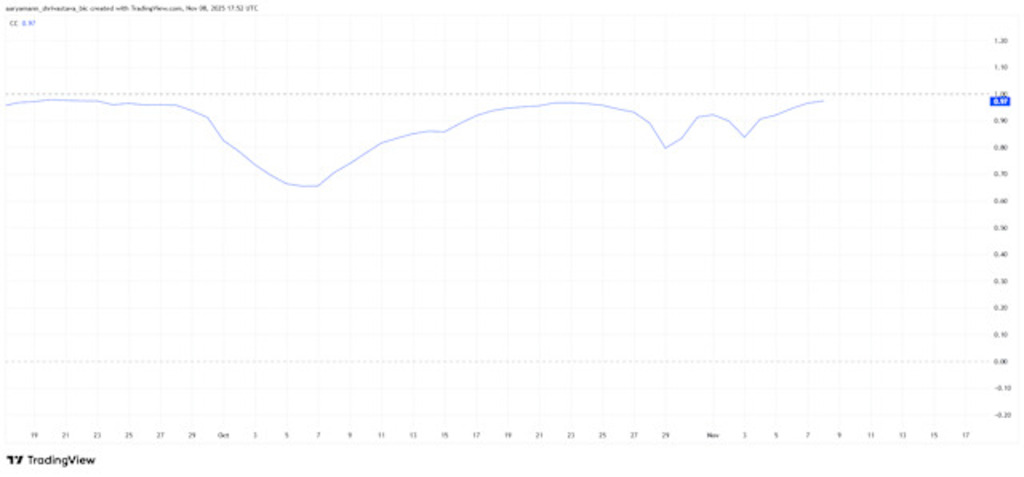

After weeks of uneven trading, Bitcoin (BTC) is once again leading moves across the crypto market. Its relationship with Solana (SOL) is drawing renewed attention, with TradingView data showing a 0.97 correlation score between them.

This indicates SOL has recently moved closely in line with BTC, a dynamic that can influence both near-term sentiment and longer-term positioning.

Solana’s Decline Highlights Bitcoin’s Market Influence

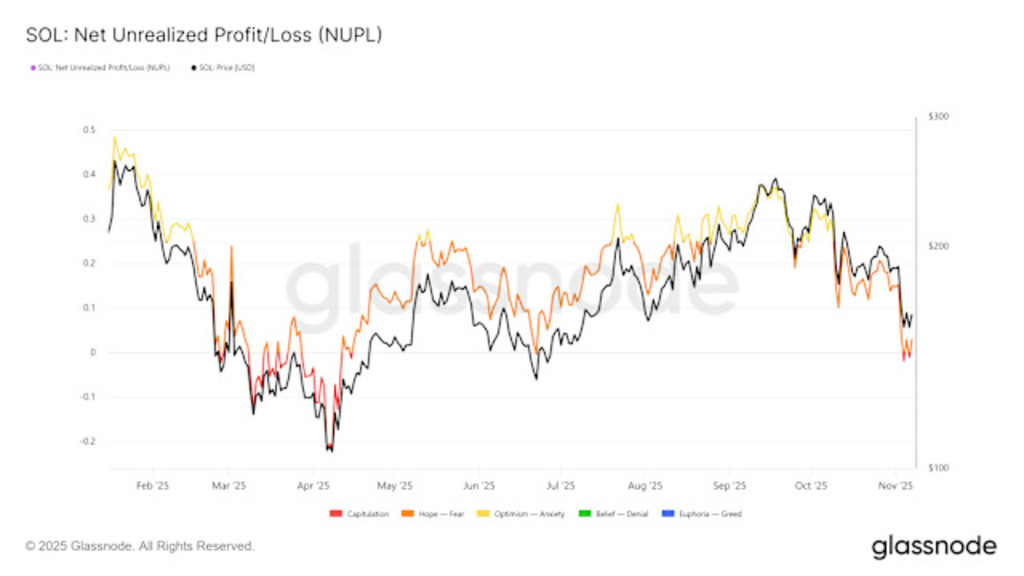

Source: glassnode

Despite attempts at recovery earlier in the quarter, Solana has remained under pressure. The altcoin trades near $157, extending its month-long decline. Some analysts say this performance highlights how closely SOL has been tracking Bitcoin’s next major move.

With BTC hovering just below $100,000, the lack of sustained upward momentum has limited Solana’s rebound. If Bitcoin weakens further, SOL could also move lower, with $150 and $146 cited by some traders as potential areas of interest.

From a broader perspective, Solana’s Net Unrealized Profit and Loss (NUPL) indicator has entered what Glassnode labels the capitulation zone. Some market participants view this as a sign of stress that can coincide with bottoming periods, though such indicators are not predictive on their own.

As one commentator put it, “Solana isn’t trading on its own terms right now. It’s living and breathing Bitcoin’s chart.”

Bitcoin Shows Signs of Stabilization

Source: TradingView

Despite choppy trading, some market observers have interpreted BTC’s consolidation near six figures as consistent with previous periods of slower accumulation, while noting that past patterns do not guarantee future outcomes.

Some on-chain metrics show exchange reserves declining, which is sometimes read as coins moving to longer-term storage. Commentators have pointed to the $105,000–$110,000 area as a possible zone to watch if momentum improves, although price targets remain speculative.

If BTC strengthens, correlated assets such as Solana may also see renewed interest; if it weakens, correlations can amplify downside moves as well.

Remittix: Payments-Focused Project Profile

Alongside major assets such as Bitcoin and Solana, some readers may be watching newer payments-focused projects. Remittix (RTX) describes itself as aiming to connect crypto transfers to traditional banking rails in certain jurisdictions.

According to project materials, the service is intended to support sending digital assets to bank accounts in 30+ countries, with settlement and foreign-exchange costs depending on the route, counterparties, and compliance requirements.

The project has also reported running an early-stage token sale and publishing fundraising and holder figures, as well as discussing potential exchange listings. These details are project-reported and may change.

Project website (for reference): https://remittix.io/

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.