TL;DR

- Lido DAO proposed an automated buyback system designed to remove LDO tokens from circulation while boosting on-chain liquidity through LDO/wstETH positions.

- The mechanism will activate only when ETH exceeds $3,000 and annual revenues surpass $40 million, allocating up to 50% of the surplus with a $10 million yearly cap.

- Inspired by MakerDAO’s Smart Burn Engine, the model will use EasyTrack and Stonks v2 to execute buybacks autonomously and strengthen on-chain governance.

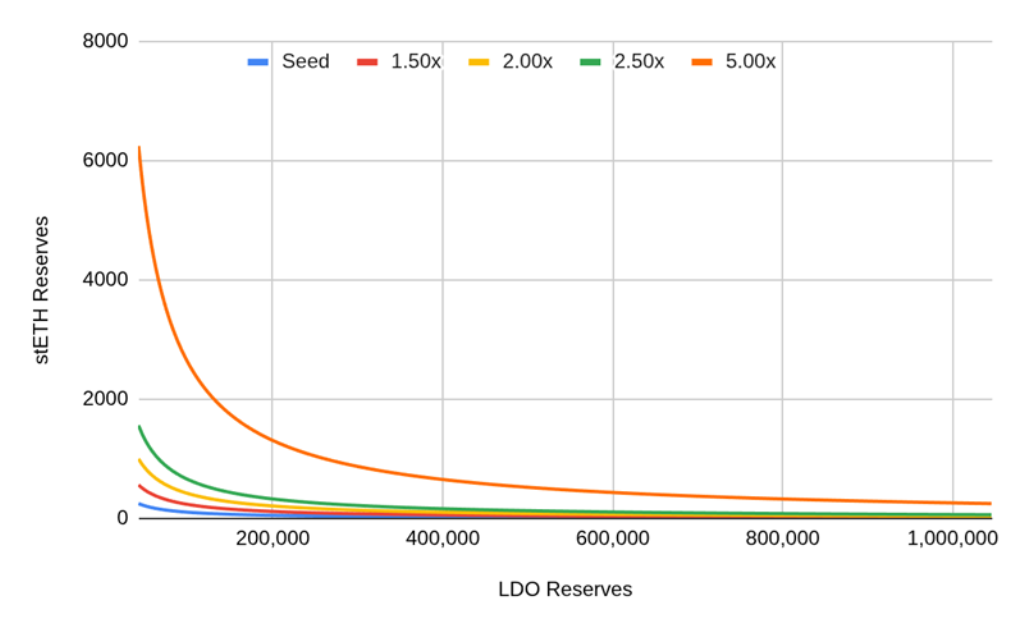

Lido DAO has introduced an automated buyback framework that will remove LDO tokens from the market while simultaneously deepening its liquidity across the DeFi ecosystem. The system will leverage the NEST framework and deploy LDO/wstETH positions in a Uniswap v2-style pool managed by the Aragon Agent contract.

How Will the Buybacks Work?

The proposal suggests executing buybacks only under high-profit conditions, specifically when ETH trades above $3,000 and the DAO’s annual revenues exceed $40 million. In such cases, up to 50% of staking inflows above that threshold would be allocated, with a cap of $10 million over a rolling 12-month period and a maximum market price impact of 2%.

The model follows an anti-cyclical logic: it allocates more funds during bullish phases and pauses during downturns to prevent treasury drain. Based on current projections, buybacks would represent roughly $4 million annually, executed through at least twelve $350,000 transactions, using around 100 stETH per operation.

Unlike a standard buyback, the system not only removes LDO from circulation but also increases on-chain market depth for the token across decentralized exchanges. The DAO plans to use part of its available stETH to create liquidity pairs that keep tokens out of circulation while generating 1–3 basis points in fee revenue for the treasury.

Lido Takes Inspiration from MakerDAO

Lido’s model draws inspiration from MakerDAO’s Smart Burn Engine but adapts it to a fully autonomous governance logic. All operations will be executed automatically through EasyTrack and Stonks v2, without human intervention, while LP positions will remain under custody of the Aragon Agent, always controlled by LDO holders.

Lido DAO has opened the proposal for community feedback before submitting it to a Snapshot vote. If approved, the mechanism could go live in Q1 2026, setting a new benchmark for liquidity management and token-burning frameworks in DeFi