TL;DR

- Zcash (ZEC) maintains support at $23 and resistance near $26.50.

- Halo 2 drives privacy and scalability improvements without trust configuration.

- Electric Coin Company (ECC) advances interoperability with Ethereum layer 2 networks.

Zcash (ZEC) is trading at approximately $24.73 USD, showing a slight upward correction following a period of market stagnation. Over the past week, ZEC has seen modest volatility, reflecting the broader uncertainty in the altcoin market, which has been influenced by Bitcoin’s consolidation around the $70,000 range.

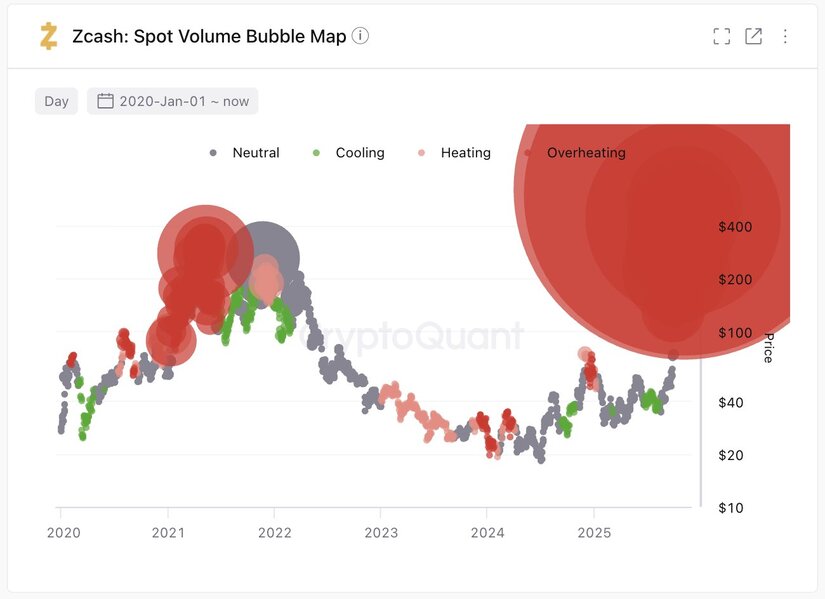

The trading volume for ZEC remains relatively low compared to its 2021–2022 levels, suggesting a decline in speculative activity and a stronger focus from investors on long-term fundamentals and privacy-related use cases.

Zcash (ZEC) rose about 1,500% over two months and reached $750, its highest level since January 2018. Public endorsements from Naval Ravikant and Arthur Hayes helped fuel buying momentum. Hayes projects $1,000 in 2025 and a long-term target of $10,000. Market indicators now show elevated risk of a steep correction.

Recent news about the Zcash blockchain highlights ongoing development toward its Halo 2 zero-knowledge proof system, aimed at enhancing privacy and scalability without trusted setup requirements. The Electric Coin Company (ECC), which manages Zcash’s protocol development, has emphasized its commitment to improving shielded transactions and integrating cross-chain privacy solutions.

One notable update in late October 2025 involved discussions about interoperability with Ethereum Layer-2 networks, a move that could expand Zcash’s privacy utility across DeFi ecosystems. Additionally, there have been community debates surrounding the future of ZEC’s monetary policy, particularly regarding the funding mechanism for ecosystem development as the founders’ reward nears its expiration.

Market sentiment toward Zcash remains neutral to mildly bullish

Technical indicators show consolidation above the $23 support level, with resistance near $26.50. The Relative Strength Index (RSI) sits around 54, suggesting neither overbought nor oversold conditions. On-chain activity has slightly increased in the last 30 days, indicating renewed interest from privacy-focused investors. If Bitcoin maintains stability and altcoin sentiment continues to improve, ZEC could test the $28–30 range by early December. Conversely, a bearish reversal in the broader market could push the price back toward $21.

CryptoQuant data highlights market overheating. The Spot Volume Bubble Map shows the largest red cluster ever for ZEC spot volume. A similar signal in 2021–2022 preceded a collapse greater than 95%. On the weekly chart, price approaches the 20-week EMA near $230, roughly 62% below current market value. The EMA often acts as a reference during corrections after rapid advances.