The UNI token has rebounded to $6.86, driven by renewed interest in the “fee switch,” a proposal that would allow revenue sharing with holders.

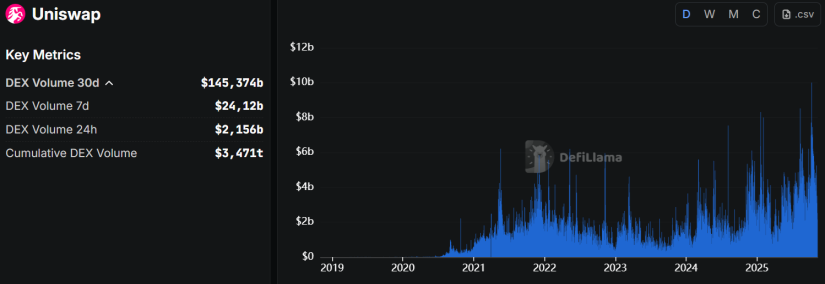

The surge came after Polymarket opened a market on the potential activation of the fee-sharing mechanism, showing a 73% probability for summer 2026. Currently, liquidity providers receive all of the protocol’s earnings. In October, Uniswap recorded an all-time high of $275 million in fees, surpassing its 2021 peak and reinforcing expectations that UNI could become a revenue-generating token.

Despite the recovery, UNI continues to trade in the lower range of the past three months, with declining open interest and limited participation from large investors. According to Messari, its social attention grew by 44% in November, suggesting that the token is still perceived as undervalued.

Source: https://defillama.com/protocol/dexs/uniswap

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.