TL;DR

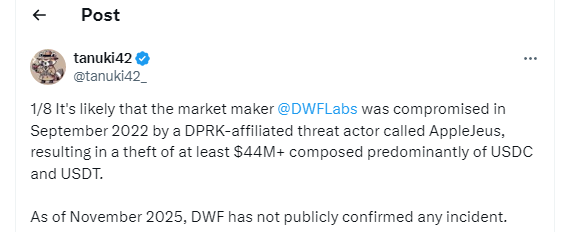

- A blockchain researcher claims that DWF Labs was compromised in 2022, with over $44 million allegedly stolen, mostly in USDC and USDT.

- The exploit appears to be linked to AppleJeus, a group associated with North Korea.

- While still unconfirmed by DWF Labs, the event highlights cybersecurity weaknesses across centralized platforms and encourages stronger protection practices for digital asset firms.

Crypto investment firm and market maker DWF Labs is reported to have suffered a major security incident in September 2022, with more than $44 million drained from multiple exchange accounts. The allegation surfaced this week through independent blockchain investigator Tanuki42, who shared detailed on-chain findings on X. Although DWF Labs has not addressed the claims, the security incident is gaining attention due to the alleged involvement of the AppleJeus hacking group, known for targeting crypto platforms globally.

According to the researcher, the breach began on September 22, 2022, when funds started moving out of several centralized exchange accounts over multiple hours. Data tied to the wallet activity suggests that both private keys and user information were compromised, allowing the attackers to bypass safeguards. A follow-up transaction the next day indicated the exploit may not have been immediately detected.

Funds were reportedly transferred through the Ren protocol and converted into Bitcoin, with a portion later routed through a mixer service. The movement was allegedly combined with assets from prior AppleJeus-related security events, which have targeted platforms such as Deribit, Tower Capital, and Radiant. The claims received input from well-known blockchain analyst ZachXBT, who contributed visual mapping of the fund flows.

Growing Concerns Around Centralized Security

If verified, the incident would rank among the largest undisclosed losses involving a market-making firm. The lack of immediate public communication from the company has sparked debate among analysts about reporting standards for breaches in the sector. Still, many industry voices advocate for balanced perspectives to avoid undermining the progress of digital assets as a financial technology.

DWF Labs has remained active in investments despite the allegations. The firm recently co-led a $21 million Series B funding round for blockchain project IOST, reflecting continued confidence in its long-term business operations.

Industry Perspective And Recent Security Events

The revelation comes shortly after a separate incident affected Balancer v2, where over $128 million was taken across multiple networks. Cybersecurity specialists note that both centralized and decentralized platforms remain targets due to their liquidity and innovative features. Experts recommend ongoing education, infrastructure audits, and investment in defensive technologies rather than discouraging participation in the sector.