TL;DR

- Banco Inter and Chainlink completed a pilot that settled cross-border trade transactions in real time between Brazil and Hong Kong using CBDCs and smart contracts.

- The pilot integrated Brazil’s Drex network with Hong Kong’s Ensemble platform, automating the flow of funds and asset records across jurisdictions.

- The project involved Standard Chartered, GSBN, and 7COMm, demonstrating that blockchain can streamline international payments.

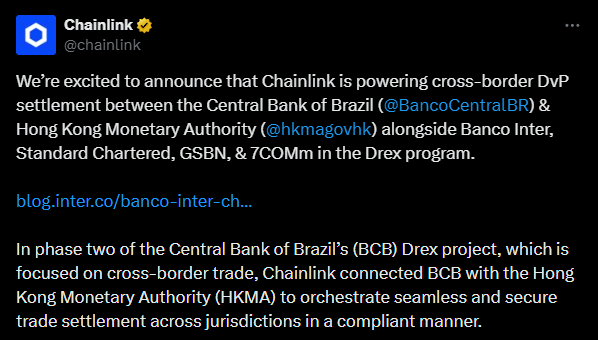

Banco Inter and Chainlink completed a pilot that enabled the central banks of Brazil and Hong Kong to settle a cross-border trade transaction in real time using digital currencies and smart contracts.

The project is part of Phase 2 of the Central Bank of Brazil’s Drex initiative, which aims to implement a digital version of the real. The test connected Brazil’s Drex network with Hong Kong’s Ensemble platform, overseen by the HKMA, using Chainlink’s infrastructure to automate the movement of funds and asset records across jurisdictions.

The pilot included tests of delivery-versus-payment (DvP) and payment-versus-payment (PvP) models, allowing simultaneous transfers of goods and payments, significantly reducing settlement risk. The system also supported conditional and installment-based payments, releasing funds only when specific stages of the transaction were confirmed. This demonstrates that blockchain-based solutions can manage complex international trade processes efficiently and securely.

Chainlink Penetrates Banking Infrastructure

According to Bruno Grossi, Head of Digital Assets at Banco Inter, integrating Chainlink enables connectivity between central banks and trade finance platforms, creating a more interconnected financial ecosystem capable of supporting the future global trade infrastructure. The banks chose to use CBDCs rather than other crypto assets, such as stablecoins.

The project included participation from Standard Chartered, the Global Shipping Business Network (GSBN), and 7COMm. GSBN managed updates to the electronic bill of lading (eBL) as part of the payment process, demonstrating the integration of digital assets with physical trade flows.

A More Inclusive Financial Ecosystem

The results of this pilot open the door to what could become a more inclusive trade finance ecosystem. By eliminating manual processes and improving coordination across platforms, the solution could lower costs for banks and exporters, especially small businesses. The next step is to expand testing to additional trade models and connect with more financial institutions.