TL;DR

- BlackRock and Securitize restructured BUIDL, reducing its Ethereum exposure by nearly 60% and redistributing assets to Avalanche, Aptos, and Polygon.

- The fund’s total value remains at $2.8 billion, indicating that the operation was a liquidity redistribution rather than capital withdrawals.

- BUIDL is backed by U.S. Treasury bonds, cash, and repurchase agreements.

BlackRock and Securitize restructured the composition of BUIDL, the largest tokenized fund globally, reduced its Ethereum exposure, and redistributed assets to other blockchains.

What’s Happening with BUIDL?

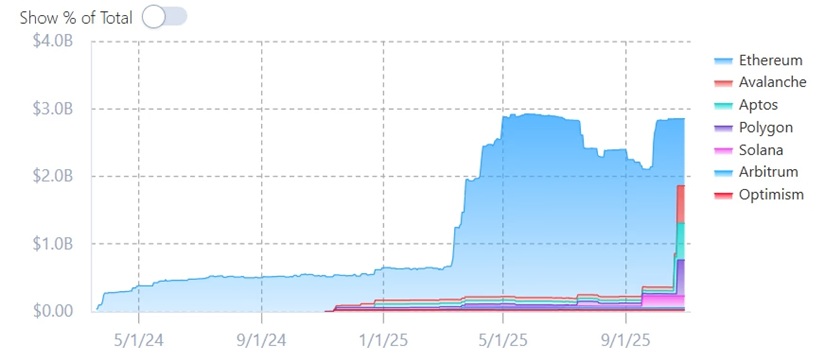

According to RWAxyz data, BUIDL’s value on Ethereum fell from $2.4 billion to around $990 million between October 19 and 30, a drop of nearly 60%. During the same period, positions on Avalanche, Aptos, and Polygon increased sharply, going from $54.3 million, $43.4 million, and $30.7 million to $554.7 million, $544.1 million, and $530.9 million, respectively. The total fund value remains around $2.8 billion, indicating that this operation did not involve withdrawals but rather a structural liquidity redistribution.

BUIDL was launched in March 2024 exclusively on Ethereum but began its expansion to other networks at the beginning of this year. Until now, the majority of assets remained on the main network, making the fund a direct reference for institutional tokenization on Ethereum. Now, the vehicle’s exposure is evenly distributed across multiple blockchains. Neither BlackRock nor Securitize commented on the decision, but the data indicates a strategic shift toward a multi-chain operational model.

BlackRock Plays a Key Role in Tokenization Expansion

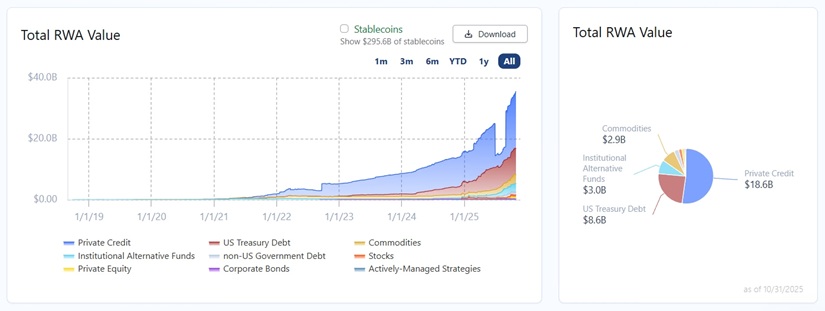

BlackRock’s fund is the largest RWA product on the market, with over $2.85 billion in assets backed by U.S. Treasury bonds, cash, and repurchase agreements. It allows qualified investors to hold tokens on the blockchain and receive dividends directly.

The total value of tokenized RWAs exceeds $35.6 billion, an 8.8% increase over the past 30 days. Ethereum still concentrates around 53% of the total value, with nearly $12 billion, but the growth of Avalanche, Aptos, and Polygon shows a trend toward infrastructure diversification.

BlackRock manages over $13.4 trillion in assets and works to promote institutional adoption of tokenization. Its technical partner, Securitize, announced plans to go public via a merger with Cantor Equity Partners II, a SPAC backed by Cantor Fitzgerald. The deal is valued at $1.25 billion