Every crypto investor would agree that October has been a hellish month this year, with Bitcoin hitting a new all-time high at $126,295 at the beginning of it, only to set a low not seen since July at $102,329 just a couple of days later. As “Uptober” comes to an end, everyone’s eyes are on what November has in store for major cryptocurrencies.

Moreover, the heatmap by CryptoRank of monthly returns is dominated by red and green patches. Still, November stands out, with an average gain of over 40% across the years.

According to expert analysts, investing in Hyperliquid (HYPE), Solana (SOL), Algorand (ALGO), and the emerging PayFi star, Remittix (RTX), could be the ultimate blueprint for achieving massive returns in November. Here’s why.

Hyperliquid Recent Inflow Spikes Optimism

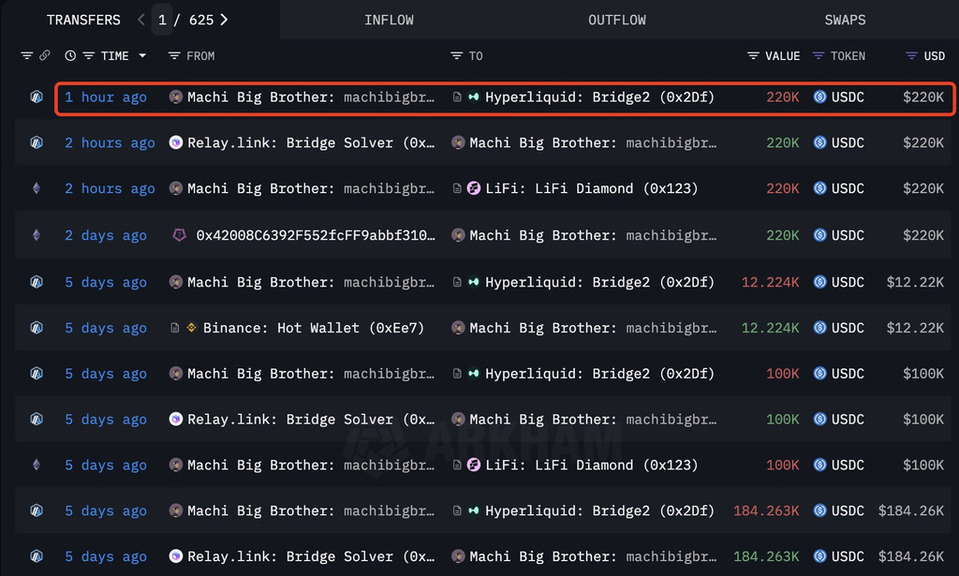

Source: Lookonchain on X (Twitter)

Machi Big Brother, a crypto investor and influencer, recently deposited an additional 220,000 USDC into the decentralized trading platform Hyperliquid, a sign of further bullish optimism in the HYPE crypto.

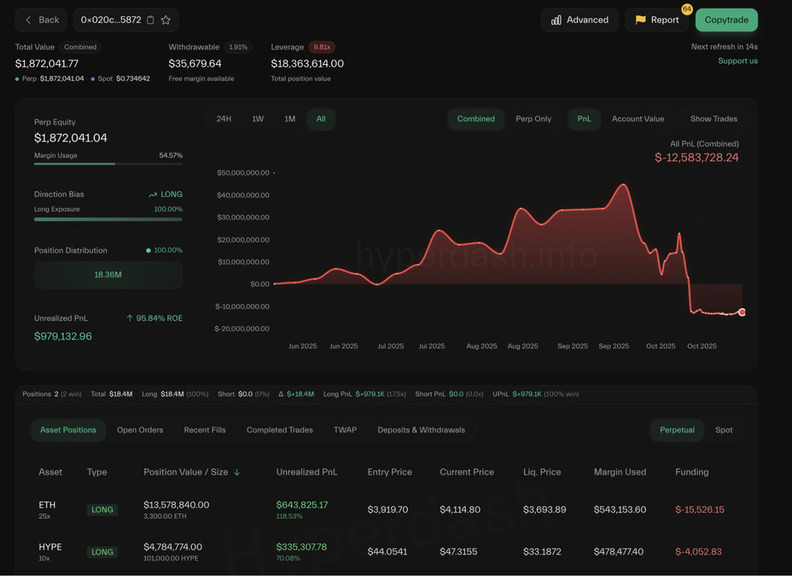

Source: Lookonchain on X (Twitter)

On-chain data suggests that Machi currently holds 3,300 ETH, valued at approximately 13.58 million, and 101,000 HYPE, valued at approximately 4.78 million, with 10x leverage. Experts tip a boom ahead.

Algorand Dips But Ecosystem Growth Shows Promise

The Algorand (ALGO) price may remain negative, dipping to $0.1840, after a 47% decline from its July high. Still, Algorand’s on-chain data paints a picture of growth: asset creation is up 30%, monthly active users have risen by 13.3%, and transactions have climbed 32% to 24.32 million. However, its total value locked (TVL) plunged from $325 million to $124 million, indicating persistent liquidity outflows.

Experts describe the Algorand (ALGO) price trend as a mismatch between strong fundamentals and weak market pricing. They dub Algorand a solid but undervalued project.

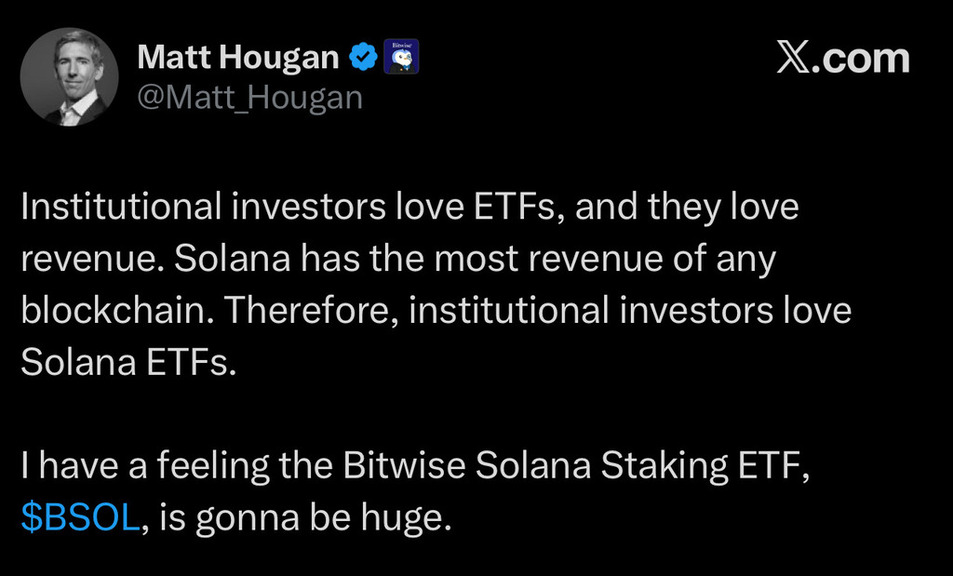

Solana Receives ETF Boost

Bitwise Asset Management’s spot Solana ETF attracted $69.5 million in inflows on its debut on Tuesday. Hence, it outpaced Rex-Osprey Solana Staking ETF SSK’s $12 million debut inflow, according to data from Farside.

In a recent tweet on Tuesday, Matt Hougan, CIO of crypto index fund manager Bitwise Invest, says, “I have a feeling the Bitwise Solana Staking ETF, BSOL, is gonna be huge. Institutional investors love ETFs, and they love revenue. Solana has the most revenue of any blockchain. Therefore, institutional investors love Solana ETFs.” Looking promising.

How About The PayFi Sensation, Remittix with 93% Bullish Sentiment

Introducing the Remittix token, a fast-rising asset that has smashed records thanks to the acceptance its solution has enjoyed. Remittix presents a PayFi solution that simplifies cross-border remittance with low gas fees and working products like its mobile-first wallet.

With 93% bullish sentiment, there’s a reflection of the project’s over eightfold growth this year, with ecosystem developments that experts believe could deliver another multifold growth.

Here’s why:

- The success of the Remittix wallet for cross-border payment. Still in beta testing, but launch is close

- Already secured listing on two top exchanges (BitMart and LBANK)

- Dominance in global payment as crypto to fiat payment sees an early spike in demand

- Over $27.7 million raised in funding after selling more than 681 million of its RTX tokens already

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.