TL;DR

- The Ethereum Foundation moved approximately 160,000 ETH, worth nearly $700 million, to a wallet previously used for large ETH transfers.

- This comes amid weak demand for Ether ETFs, which have seen nearly $500 million in outflows recently.

- The Foundation confirmed the transfer was part of an operational wallet migration, not a sale, but the timing has sparked discussion about asset management and ETH strategy.

The Ethereum Foundation recently moved around 160,000 ETH, valued at close to $700 million, to a wallet known for transferring funds to exchanges. This action has drawn attention from traders and analysts as Ether ETFs continue to struggle with low investor demand. The transaction has also increased speculation about how the Foundation will manage future ETH liquidity and fund upcoming development initiatives.

Ethereum Foundation And The Wallet Movement

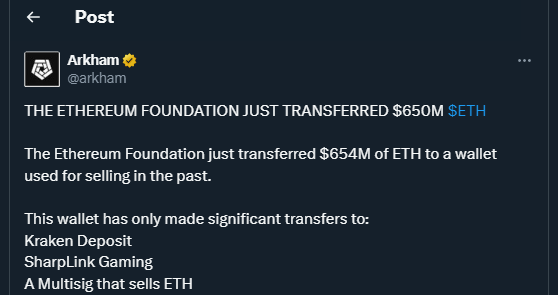

On-chain data from Arkham Intelligence confirmed the transfer took place on October 21. The receiving wallet has a history of facilitating large ETH sales, which sparked speculation about a potential liquidation. Ethereum Foundation co-Executive Director Hsiao-Wei Wang clarified that the transfer is part of a planned wallet migration for operational purposes, with no sale involved. Despite this explanation, the move coincides with discussions around internal restructuring and staff reductions, fueling market curiosity. Observers also note that the Foundation has been adopting more transparent reporting practices to reassure investors and stakeholders.

Weak Demand From Ether ETFs Adds Pressure

Meanwhile, Ether ETFs are seeing notable outflows. According to SoSoValue, US-based spot Ether ETFs experienced $145 million in net outflows on October 20, contributing to nearly $500 million in total outflows over the past two weeks. ETH’s price, which reached nearly $4,959 in August, has declined to around $4,000 and is testing support near $3,900. Analysts suggest maintaining levels above $4,100 is key for bullish momentum, potentially pushing ETH toward $5,800 in the coming weeks. Several traders are closely monitoring whale movements and wallet activity, expecting volatility in response to any additional large transfers.

The Foundation is also facing internal challenges. Former lead developer Péter Szilágyi recently resigned, citing underpayment over six years despite Ethereum’s market growth. Wang acknowledged that veteran developers were underpaid but emphasized ongoing adjustments in operations, including staff streamlining, improved financial management, and careful ETH sale planning. Even with this large transfer, the Foundation retains about $827 million in crypto assets, including ETH, BTC, BNB, and ARB. Smaller recent sales have funded research and DeFi initiatives, reflecting a cautious approach while supporting the ongoing Ethereum ecosystem and encouraging long-term development projects.