TL;DR

- Aster was quietly reinstated on DeFiLlama, but with missing historical data, which reignites concerns about transparency in DeFi analytics.

- Despite those gaps, its strong performance in perpetual volume keeps traders and builders engaged.

- The situation renews debate over who controls visibility in decentralized markets and how data systems can evolve without slowing innovation.

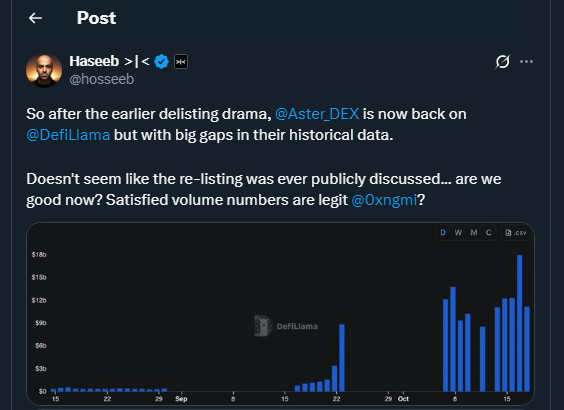

Aster’s reinstatement on DeFiLlama has sparked more curiosity than backlash among crypto users who prioritize onchain experimentation over gatekeeping. While some observers pointed out absent historical metrics, the broader reaction in trading circles has been pragmatic and relatively calm. For those tracking liquidity flows and protocol momentum, Aster’s recent performance outweighs concerns about incomplete archives, especially in highly competitive derivatives environments.

Rather than treating the relisting as a setback, many analysts see it as a test for data platforms adapting to new exchange structures. DeFi protocols scale quickly, and indexing tools often struggle with offchain components or novel execution layers. A growing number of developers also see value in hybrid reporting methods that blend analytics with open verification. Aster’s team reportedly supplied updated endpoints and internal metrics to accelerate its reappearance on the site.

Growing Interest In Perp Volume

Since returning to DeFiLlama, Aster has held top positions in daily and weekly perpetual futures rankings. It now competes closely with Hyperliquid and Lighter in categories that traders monitor for yield and liquidity signals. Developers building dashboards or bots note that core volume metrics remain visible, even if historical comparisons are limited by the data void.

Industry watchers argue that future integrations could move faster as protocols adopt standardized reporting layers and push for better interoperability. This theme is becoming more common among analysts who want to mix transparency with competitive edge. Some interpret the episode as proof that data reliability is part of product positioning in a market where speed matters.

New Metrics On The Horizon

DeFiLlama has hinted at expanding how it tracks exchanges, focusing on greater detail in order flow, liquidity fragmentation and revenue metrics. While the missing data leaves short-term gaps in Aster’s record, it also lets both sides test new tracking models without legacy constraints or outdated assumptions.

Several researchers contend that incomplete data does not erase credibility, especially when onchain usage and treasury activity are visible and traceable. Others argue that standardized transparency can curb manipulation without forcing protocols into rigid molds. For now, Aster’s return highlights the market’s preference for performance and liquidity first, and data patching second.