TL;DR

- Ethereum is facing a historic liquidity shortage. One-third of the supply is staked, and a large portion of tokens remain inactive.

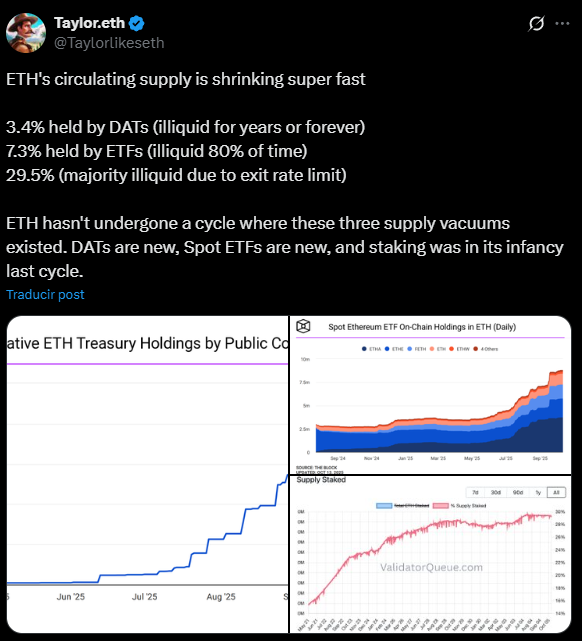

- ETFs and public companies hold over 6.8 million ETH ($28 billion), reducing exchange liquidity and increasing price sensitivity.

- The market anticipates rallies that could push the price to $8,000–$10,000, although a breakout is not guaranteed.

Ethereum is experiencing an unprecedented liquidity shortage, with much of its supply out of circulation due to staking, ETFs, and inactive wallets.

About one-third of the total supply is locked in staking contracts, where withdrawals can take weeks. Another significant portion resides in decentralized treasuries or dormant wallets, many of which may not move for years.

Ethereum Could Face Severe Pressure During Demand Spikes

On-chain researchers describe the situation as a “liquidity blackout.” The combination of staking, ETF accumulation, and long-term storage has simultaneously reduced the available supply, creating a scenario never seen before. Institutional demand could amplify this effect, triggering sharp price increases during demand surges.

U.S.-listed ETFs have absorbed more than 6.8 million ETH, equivalent to $28 billion. Public companies hold over 12% of Ethereum’s total supply. Bitmine exceeded $12 billion in ETH, controlling nearly 5% of circulating tokens. This structural accumulation removes coins from circulation and decreases liquidity on exchanges, increasing price sensitivity during sudden demand shifts.

Toward $10,000 per ETH?

Ethereum reserves on Binance have fallen to their lowest level since May. Investors are moving assets to private wallets or staking pools. Historically, this pattern has coincided with strong price rallies when scarcity meets market optimism. Ted Pillows projects that ETH could reach $8,000–$10,000 within the next year, driven by undervaluation.

However, some firms warn that scarcity does not guarantee sustained price gains. Ethereum has not yet established momentum above its previous peak, and some analysts consider that reduced liquidity and the “supply vacuum” do not ensure an immediate breakout.