TL;DR

- Arthur Hayes interprets Jerome Powell’s latest speech as a clear signal that quantitative tightening has concluded, paving the way for renewed monetary expansion.

- He believes this environment will boost liquidity, favoring Bitcoin and other cryptocurrencies.

- Hayes emphasizes that easier monetary conditions increase appetite for risk, positioning digital assets as key beneficiaries of a potential surge in investor interest and capital flows toward crypto markets.

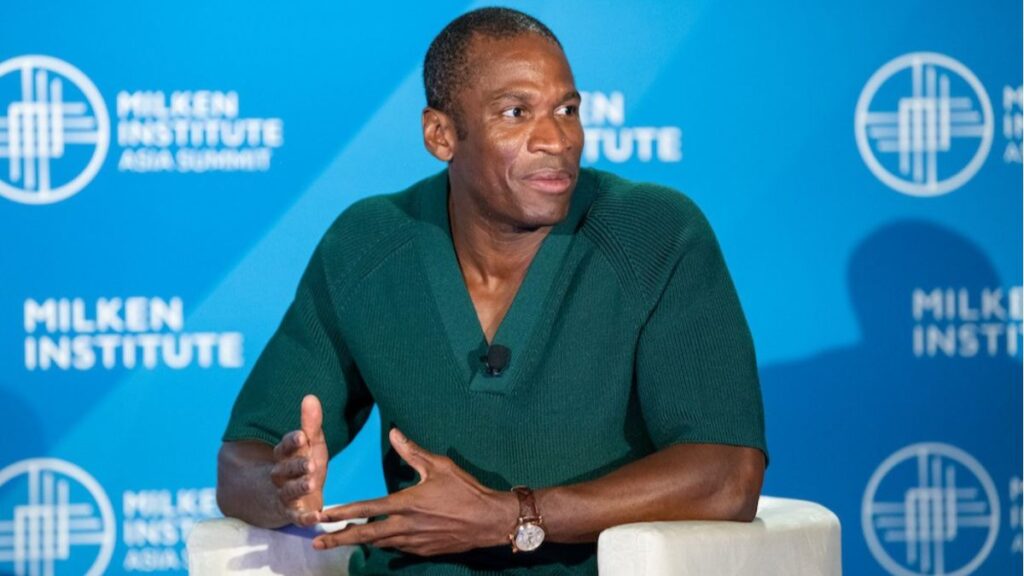

Arthur Hayes, the influential BitMEX co-founder, has sparked optimism in the crypto market with his take on Jerome Powell’s recent speech. Unlike many analysts who approached the Fed chair’s comments with caution, Hayes framed them as strongly supportive of risk assets, particularly cryptocurrencies. His commentary immediately gained traction on social media, generating discussion among traders and analysts worldwide about the potential trajectory for digital assets in the coming months.

Who Arthur Hayes Is And Why His Opinion Matters

Hayes is not just a pioneering figure in crypto derivatives; his extensive background in traditional finance gives him a unique lens to analyze macroeconomic shifts. As co-founder of BitMEX, one of the world’s leading crypto derivatives platforms, Hayes combines technical understanding with bold market perspectives. His insights often move market sentiment because they bridge conventional finance and the digital asset ecosystem, making his interpretations closely watched by traders and investors alike. Many see his analysis as a reference point for positioning portfolios under evolving monetary conditions.

Powell’s Speech Interpreted As Monetary Easing

While the Fed’s rhetoric initially focused on inflation concerns, Hayes read Powell’s words as a signal that quantitative tightening, the Fed’s process of reducing its balance sheet, has ended. In Hayes’ view, this sets the stage for renewed monetary expansion. He summarized his reaction succinctly, advising a “buy everything” approach, emphasizing the potential upside for cryptocurrencies under a more accommodating policy. Some investors have already adjusted their strategies, reallocating capital toward higher-risk assets in anticipation of more supportive financial conditions.

Implications For The Crypto Market

Hayes highlights three primary factors supporting crypto. First, liquidity expansion increases demand for scarce assets like Bitcoin, which could drive its price higher. Second, fears of renewed inflation may push investors toward Bitcoin as a digital store of value. Finally, easier financial conditions tend to boost risk appetite, sending capital into high-risk assets, including cryptocurrencies.

Hayes believes these conditions create a fertile environment for digital assets to flourish, signaling a possible new phase of growth and investment in the sector. Traders and institutions are closely monitoring these shifts, hoping to capitalize on opportunities created by a more accommodative Fed policy.