TL;DR

- Elon Musk reaffirmed his support for Bitcoin, describing it as “based on energy” and superior to fiat currencies, which governments can print endlessly.

- He framed Bitcoin as a scarce, digital hard money system aligned with the AI-driven energy era.

- Despite muted market reactions, his comments reinforce Bitcoin’s growing role as a reliable store of value amid rising global inflation.

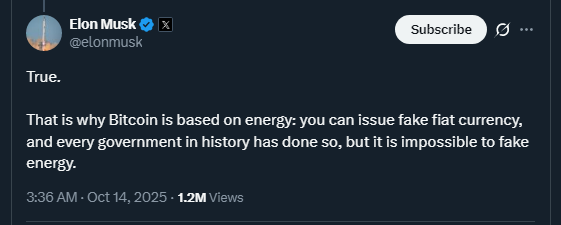

Elon Musk reignited discussions in the crypto world with a bold new statement positioning Bitcoin above traditional government-issued currencies. In a post on X (formerly Twitter), Musk highlighted Bitcoin’s energy-backed foundation, emphasizing its scarcity and resilience compared to fiat currencies, which can be printed without limit. He also noted that technological innovation and energy efficiency could further strengthen Bitcoin’s role in the financial system.

Musk Frames Bitcoin As Energy-Backed Digital Money

Responding to market analyst Zerohedge, Musk argued that Bitcoin’s reliance on energy gives it a structural advantage over fiat.

“You can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy,” he wrote.

Zerohedge’s post connected the rise of AI infrastructure and the global tech arms race to increased demand for scarce assets like gold, silver, and Bitcoin. Musk’s remarks position Bitcoin as a “proof-of-energy” system where trust is anchored in computational work and real-world energy consumption, rather than arbitrary printing by central banks.

The discussion ties into a larger macroeconomic narrative: energy, scarcity, and digital value. As AI and data center growth accelerate, Musk’s framing of Bitcoin highlights its potential as a stable digital store of value when other assets are increasingly inflated by government spending. Industry experts suggest this perspective could encourage more long-term institutional investment in digital assets.

Tesla And Musk Maintain Long-Term Bitcoin Commitment

This statement aligns with Musk’s previous positions on Bitcoin. He has consistently held onto his BTC, ETH, and DOGE, viewing scarce digital assets as a hedge against inflation. Tesla also continues to maintain one of the largest corporate Bitcoin treasuries, reportedly holding around $1.4 billion as of October 2025, according to Arkham Intelligence.

Despite Musk’s endorsement, Bitcoin’s price remained relatively flat, trading at $111,836, reflecting ongoing investor caution. Analysts suggest that while Musk’s posts often sway smaller, volatile segments of the market, the long-term influence reinforces confidence in Bitcoin’s structural scarcity and energy-based credibility.

Musk’s renewed advocacy comes at a time when the global economy is grappling with inflation and energy-driven technological expansion, underlining the argument that Bitcoin may serve as a stable digital alternative to fiat in a rapidly evolving financial landscape.