TL;DR

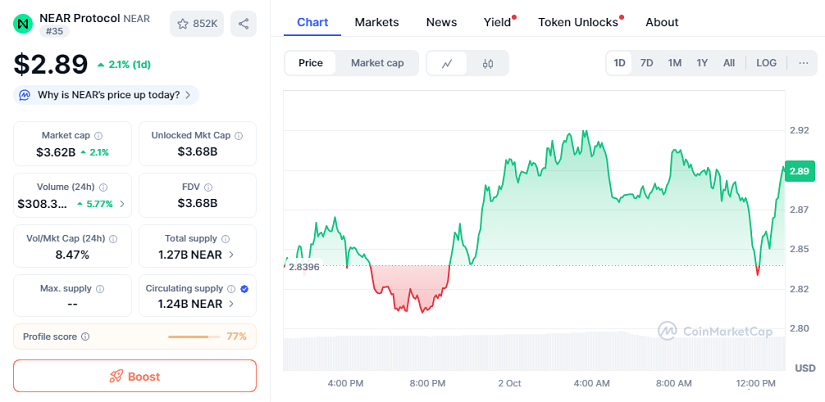

- NEAR trades at 2.89 dollars after a 2.1 percent rise in the last 24 hours while daily volume surpassed 300 million with a 5.77 percent increase that reflects renewed demand.

- Analysts point to the recent recovery of the 20 week moving average as a signal of growing momentum.

- A breakout above 4 dollars could unlock gains toward the 6 dollar region according to multiple technical projections.

NEAR Protocol continues to capture attention as buyers rotate into mid cap assets with high activity levels. The token currently trades at 2.89 dollars after delivering a 2.1 percent gain in the last twenty four hours. Trading volume has also accelerated above 300 million with a 5.77 percent expansion, indicating that recent movement is backed by liquidity rather than isolated orders.

Market capitalization has climbed to 3.62 billion dollars placing NEAR in a favorable position among emerging layer one networks. Some analysts even suggest that current price levels may still represent undervaluation when compared with networks showcasing lower adoption but significantly higher premiums.

Several specialists argue that NEAR benefits from renewed interest in artificial intelligence focused infrastructure. Its fast execution framework and developer friendly tooling allow builders to deploy automated agent systems and machine learning applications without compromising efficiency. The broader market may be overlooking the potential revenue effect of these solutions once adoption accelerates across consumer facing products offering practical automation.

Technical Metrics Favor Continued Upside

Price action remains steady above key short term support lines and the token recently reclaimed its 20 week moving average. Chart structures resemble classic breakout formations observed ahead of strong expansions in previous cycles. The four dollar zone still represents the major ceiling that traders are monitoring. A clear push beyond that threshold could activate momentum algorithms and attract sidelined capital seeking performance. Speculative demand could intensify further if open interest begins to expand on derivatives platforms during upcoming sessions.

Institutional Interest Shows Early Signals

Digital asset funds have quietly started accumulating NEAR during consolidation phases calling it one of the most asymmetric setups in the current market. Developers associated with multichain protocols have hinted at integrations that could boost liquidity depth and cross ecosystem interoperability. Order books across major exchanges display dense bid clusters suggesting that downside pressure is being consistently absorbed.

Market participants looking for assets with both speculative potential and active development now include NEAR among their top candidates. If trading volume maintains current trajectory through October, broader recognition of its expanding ecosystem could arrive faster than expected.