TL;DR

- Polymarket is preparing to reopen to U.S. users after a four-year hiatus, following regulatory approval from the CFTC.

- The platform recently acquired QCX/QC Clearing, securing a licensed exchange and clearinghouse.

- Initial offerings will focus on sports spreads, totals, and election outcome contracts, giving Americans easy access without VPNs, while complying with standard KYC and state-specific requirements.

Polymarket, one of the largest prediction markets globally, is poised to resume operations in the United States after securing critical approvals from the Commodity Futures Trading Commission (CFTC). The company’s recent acquisition of QCX/QC Clearing for $112 million ensures access to a fully licensed exchange and clearinghouse. Following a no-action letter from the CFTC in early September, Polymarket now has the ability to self-certify event contracts, clearing the path for listings in sports, elections, and other categories.

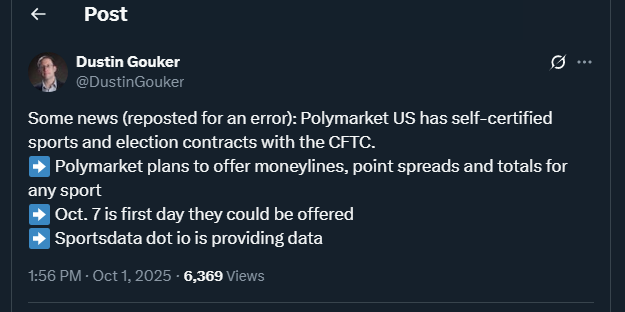

Under CFTC rules, once a designated contract market files a certification, the agency has a single business day to object. If no objection is raised, the contracts can be listed immediately. Polymarket’s filings indicate that contracts could be available to U.S. users starting October 2, 2025, although some sources suggest October 7 as a possible launch date. The platform has also hinted at integrating additional real-time analytics tools to improve user experience and market efficiency.

Initial Offerings Focus On Sports And Elections

The first contracts on Polymarket U.S. are expected to center on sports betting lines, totals, point spreads, and election outcome predictions. Sportsdata.io will provide real-time data to support these markets. U.S. users will no longer need VPNs to access the platform and will go through standard KYC and identity verification processes. State-specific limitations may apply at launch, but the overall process is designed to make participation seamless for American users. Additionally, Polymarket plans to roll out educational resources and interactive tutorials to help newcomers navigate prediction markets confidently.

Polymarket’s return is seen as a significant step in boosting the visibility and adoption of prediction markets in the U.S., and it could help the platform regain ground against competitors like Kalshi, which currently dominates with roughly 66% market share. The launch is expected to drive transaction volumes higher as the platform leverages both desktop and upcoming mobile applications.

With the U.S. market now accessible, Polymarket’s relaunch represents an important moment for mainstream adoption of crypto-based prediction markets. Analysts expect a steady growth trajectory as users explore sports and political event contracts under fully regulated conditions, making the platform a major player in the space once again.