TL;DR

- Ethereum drops after co-founder Jeffrey Wilcke transferred 1,500 ETH to Kraken, a move valued at $5.99 million.

- In the past two days, 15 wallets purchased over 406,000 ETH worth $1.6 billion, while other whales liquidated large amounts.

- ETH broke its upward trendline near $4,200; resistance lies between $4,083–$4,238 and immediate support is at $3,800, with an RSI of 29 indicating oversold conditions and potential technical rebounds.

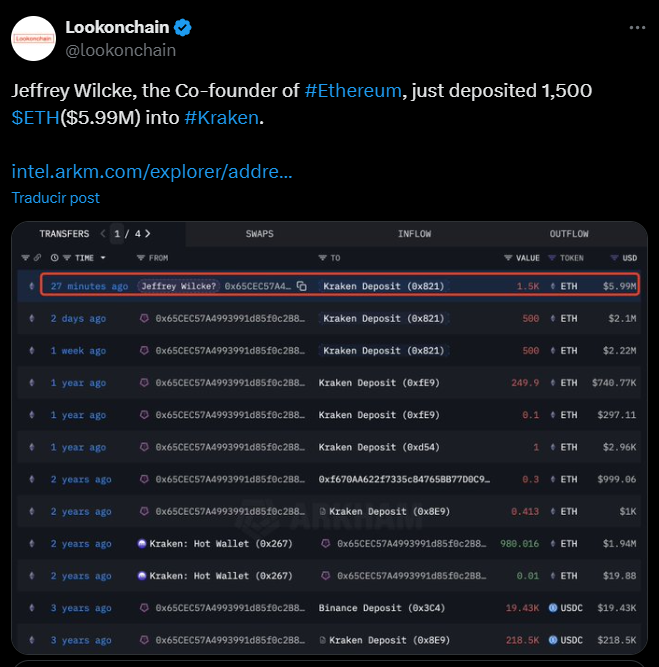

Ethereum suffered a significant decline after its co-founder, Jeffrey Wilcke, moved 1,500 ETH to the Kraken exchange, a transfer valued at $5.99 million.

Whales in Motion

The operation sparked speculation about possible additional sales. Meanwhile, ETH lost critical support and traded just below $4,000, marking an 11.6% drop over the past seven days.

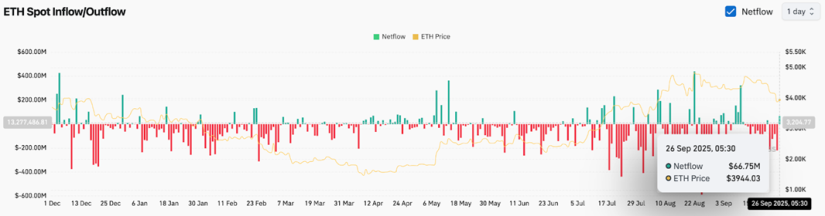

The pullback comes after weeks of mixed activity, where inflows and outflows from large wallets balanced each other. In the last two days, at least 15 wallets acquired more than 406,000 ETH, equivalent to $1.6 billion, taking advantage of lower prices, while other whales sold significant amounts, reducing the number of addresses holding over 100,000 ETH. Net flows to exchanges reached $66.7 million on September 26, suggesting that buyers may be sending coins to sell rather than hold.

Technical Analysis for Ethereum

Technical indicators show that Ethereum broke its rising trendline near $4,200, with the 20-, 50-, and 100-day moving averages now acting as resistance between $4,083 and $4,238. Immediate support is at $3,800, while lower liquidity zones between $3,500 and $3,400 could become relevant if this level is breached. The RSI at 29 signals oversold conditions, opening the possibility for technical rebounds, although selling pressure continues to dominate.

Despite short-term bearish factors, Ethereum maintains solid fundamentals: Layer-2 adoption continues to grow, institutional inflows via ETFs remain active, and Fed rate cut signals reinforce the appeal of risk assets.

Analysts warn that technical resistance remains strong, and a recovery will depend on ETH’s ability to close above $4,083 and consolidate toward $4,330. Until then, the token could continue facing selling pressure and market volatility