TL;DR

- Eleven wallets accumulated nearly 296,000 Ethereum (ETH) amid a price correction, marking one of the largest on-chain buying waves of the year.

- The largest single transfer was 41,039 ETH ($165 million) from FalconX, while other significant inflows came from Galaxy Digital OTC, Kraken, and BitGo.

- Despite volatility and liquidations exceeding $1.6 billion, exchange reserves fell to 16.5 million ETH, signaling accumulation by long-term investors.

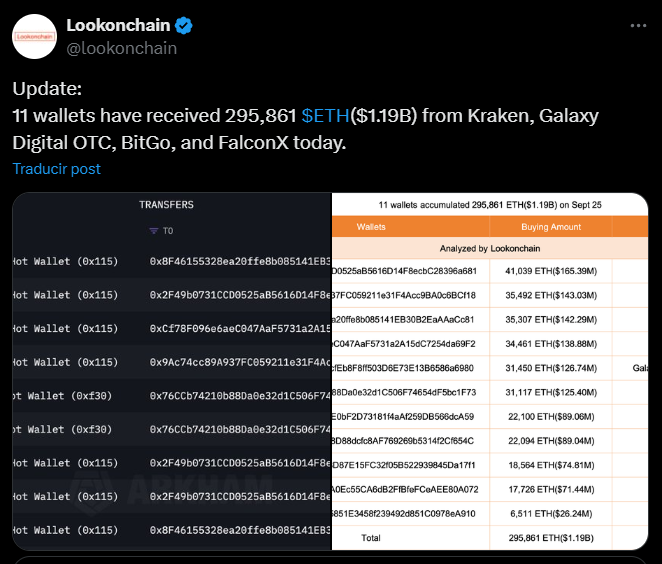

Eleven wallets amassed nearly 296,000 ETH ($1.19 billion) in one of the largest on-chain buying waves this year, according to data from Lookonchain.

The massive inflows—originating from brokers and custodians like FalconX, Galaxy Digital OTC, Kraken, and BitGo—occurred during a price correction, when Ethereum touched lows near $3,983 and leveraged positions were liquidated.

The largest reported single transfer was 41,039 ETH ($165 million) from FalconX to a single address. Other major inflows include 31,450 ETH ($126.7M) from Galaxy Digital OTC and multiple transfers from Kraken: 31,117 ETH ($125.4M), 22,100 ETH ($89M), and 22,094 ETH ($89M). BitGo also appears with transfers of 18,564 and 17,726 ETH. Altogether, the 11 wallets collected 295,861 ETH, according to Arkham Intelligence and Lookonchain.

Ethereum Fails to Break Resistance Zones

Ethereum experienced a week of intense pressure: between September 18 and 25, ETH fell after multiple failed attempts to surpass the $4,500–$4,600 resistance range. Over a single 24-hour period, more than $500 million in ETH long positions were liquidated, while total market liquidations exceeded $1.6 billion. Coinglass recorded over $100 million in forced closures during Asian trading hours, with losses exceeding $90 million on bullish BTC and ETH positions.

Despite the volatility, the accumulation trend is evident in exchange reserves: CryptoQuant reports that platform balances dropped to 16.5 million ETH, the lowest level in over a year. This decline suggests that funds were moved to private custody or staking tools, reducing immediate selling pressure.

However, whales also suffered market setbacks. An address labeled 0xa523 was liquidated on Hyperliquid for a 9,152 ETH ($36.4M) position, with cumulative losses exceeding $45 million. Another trader, identified as Machi, saw nearly $30 million of profits vanish in six days and had to inject liquidity to avoid further liquidations.

The picture is clear: long-term investors are taking advantage of price dips to accumulate, but high volatility and leverage keep the market in a fragile balance. The coming days will be decisive to determine whether Ethereum’s withdrawal from exchanges leads to consolidation or if wholesale pressure triggers further declines.