TL;DR

- Franklin Templeton is launching its Benji tokenization platform on BNB Chain, allowing regulated investment products to reach crypto-native investors efficiently.

- The platform mirrors traditional mutual funds with onchain tokens, expanding Franklin Templeton’s digital asset footprint beyond Stellar, Ethereum, and Solana.

- The collaboration with BNB Chain highlights institutional confidence in blockchain infrastructure capable of handling high-value, regulated financial products while exploring cost-effective settlement solutions.

Franklin Templeton, the $1.6 trillion global asset manager, has deployed its Benji Technology Platform on BNB Chain, reflecting a continued effort to merge traditional finance with blockchain technology. By offering tokenized investment products on a lower-cost, high-speed network, the firm aims to reach a broader crypto-savvy audience while ensuring compliance with existing regulations.

The expansion also allows investors to access fractionalized shares in regulated products, making traditionally exclusive investments more accessible. This step demonstrates that major institutions are increasingly willing to adopt blockchain as a core part of their digital strategy, potentially setting new standards for secure, transparent investment management and influencing industry-wide innovation significantly.

BNB Chain Supports Large-Scale Regulated Assets

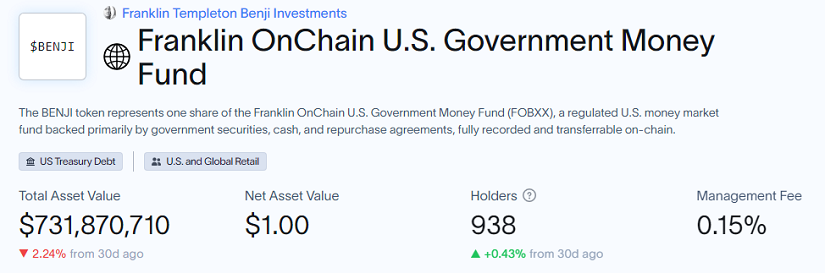

BNB Chain’s infrastructure, which already hosts tokenized credit products and money market funds, now accommodates Franklin Templeton’s institutional offerings. Sarah Song, head of business development at BNB Chain, highlighted that this expansion proves the network can manage high-value, regulated financial instruments efficiently. Benji’s history includes the Franklin OnChain U.S. Government Money Fund, with more than $730 million tokenized mainly on Stellar, followed by deployments on Ethereum, Solana, Polygon, Avalanche, Arbitrum, and Base.

BNB Chain now becomes the newest venue for these digital assets, offering faster settlement times, reduced operational costs, and enhanced transparency for institutional participants globally, while reinforcing confidence in blockchain-based financial infrastructures effectively.

Tokenization Gains Momentum Despite Challenges

Roger Bayston, head of digital assets at Franklin Templeton, stressed that meeting investors where they are active is crucial, while showing that tokenization can scale securely. Across the financial sector, tokenization is growing rapidly, with Nasdaq filing to allow tokenized stocks and ETFs to trade alongside traditional instruments, possibly by 2026.

Proponents highlight faster settlement, lower costs, increased transparency, and the potential to reduce intermediaries. Regulatory fragmentation, legal uncertainties, and technical risks remain challenges, but Franklin Templeton’s expansion indicates confidence that blockchain-based investment solutions will play a central role in shaping the future of institutional finance worldwide. This initiative may encourage more asset managers to explore secure tokenization strategies, broadening access to high-quality investment products and driving further innovation in global financial markets decisively.