TL;DR

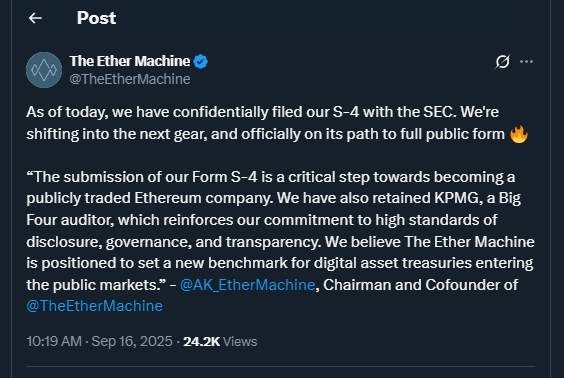

- The Ether Machine has filed a confidential draft Form S-4 with the SEC, advancing its path toward a public listing through a merger with Dynamix Corporation and The Ether Reserve LLC.

- The company recently secured $654 million in private ether financing and now holds close to 500,000 ETH.

- This position makes it the third-largest corporate Ethereum holder globally, signaling its growing influence in digital asset markets.

The Ether Machine, a leading Ethereum treasury firm, is accelerating its push into the public arena after successfully raising significant funding and expanding its crypto holdings. The company confirmed the confidential filing of its Form S-4 with the U.S. Securities and Exchange Commission, part of its plan to list publicly later this year and strengthen its role in the evolving blockchain investment ecosystem.

SEC Filing And Merger Strategy

The company aims to complete a merger with Dynamix Corporation and The Ether Reserve LLC, which would position it strongly on Nasdaq. Andrew Keys, co-founder and chairman, emphasized that the involvement of KPMG as an advisor underscores its dedication to transparency and governance. The Ether Machine believes this structure will allow it to set benchmarks for how digital treasuries integrate into regulated capital markets and attract both retail and institutional investors.

The timeline suggests that the deal could be finalized in the fourth quarter, pending shareholder approval and other customary conditions. The company has indicated that it wants to provide long-term investors with access to Ethereum’s growth through a regulated vehicle, offering an alternative to traditional ETFs and opening the door for broader adoption among conservative financial institutions.

Treasury Expansion And Market Context

Earlier this month, The Ether Machine closed a $654 million financing round in ether, bolstering its already substantial reserves. With nearly half a million ETH under management, it trails only BitMine Immersion Tech and SharpLink Gaming in corporate Ethereum holdings. By comparison, BitMine controls over 2.15 million ETH, valued at nearly $10 billion, while SharpLink Gaming holds around 838,000 ETH.

This growing concentration of ether among corporate treasuries signals increasing confidence in Ethereum’s long-term trajectory. Market analysts point out that Ethereum’s recent defense of the $4,500 support level suggests resilience, with upside targets near $4,700 if macroeconomic conditions, such as potential Federal Reserve rate cuts, align in its favor and trigger renewed momentum across the broader cryptocurrency sector.

The Ether Machine’s strategy positions it as a central player in Ethereum’s next cycle, bridging institutional finance with the decentralized economy.