TL;DR

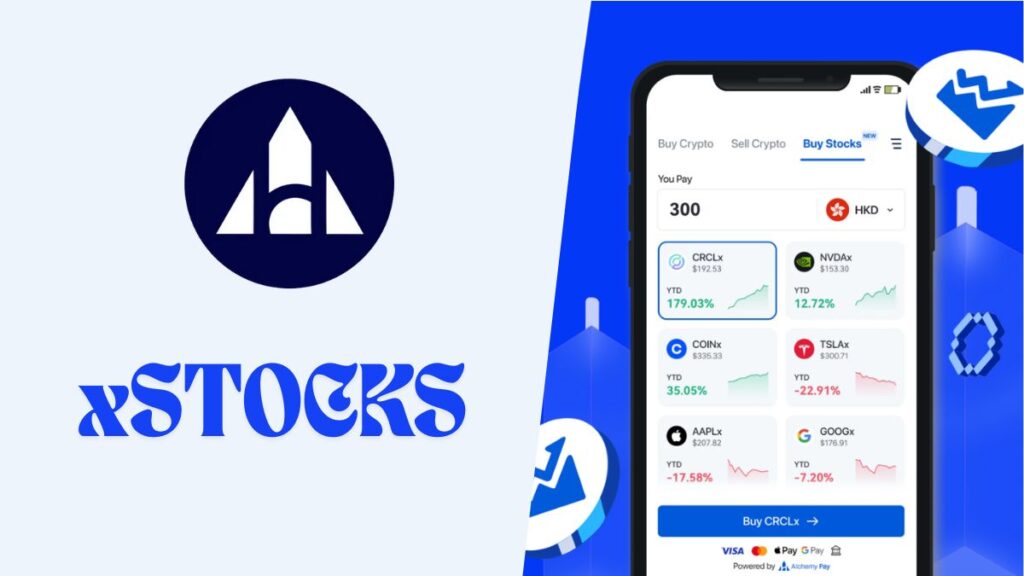

- Alchemy Pay launched a fiat-to-RWA platform in partnership with Backed’s xStocks, allowing users to purchase over 60 tokenized stocks and ETFs with local payment methods.

- The tokens are backed one-to-one by real shares held under regulated custody and include benefits such as dividends and stock splits, with a minimum investment of just $1.

- The integration of fiat payments removes the need to use cryptocurrencies, ensures real-time pricing, and provides 24/5 liquidity.

Alchemy Pay has introduced a platform that uses fiat currencies to invest in tokenized real-world assets, in collaboration with Backed’s xStocks.

The service enables direct purchases of U.S. stocks and ETFs from more than 170 countries using traditional payment methods like Visa, Mastercard, Apple Pay, Google Pay, SEPA, bank transfers, and local mobile wallets. Available assets include Apple, Tesla, Circle, Coinbase, and the SPY ETF, all represented by tokens backed one-to-one by real shares held with regulated custodians.

Fractional Ownership and 24/5 Trading

The platform aims to improve accessibility to international equity markets. A minimum investment of $1 allows users to buy fractional shares of securities that have traditionally required higher amounts. The tokens also provide the usual benefits of stock ownership, such as dividends and splits, which are key to the appeal of the offer. The company guarantees accurate pricing by aggregating real-time data from licensed U.S. providers as well as platforms like Kraken and Backed, which also support liquidity and trading in a 24/5 framework.

Unlike purely decentralized RWA solutions, the integration of fiat payments removes the need to buy crypto before accessing assets. This model provides more reliable execution, deeper liquidity, and regulatory compliance that makes global adoption easier.

Alchemy Pay as Part of a Network Driving RWA Tokenization

The partnership with Backed combines Alchemy Pay’s fiat payment infrastructure with xStocks’ regulated token issuance, creating a complete investment circuit. The product is part of a wider network involving Solana, Kraken, Bybit, and Chainlink, with the goal of bringing tokenized traditional assets to a large-scale global audience.

The tokenization of real-world assets is undergoing rapid growth. Binance Research reported that the market exceeded $23 billion in the first half of 2025, after expanding more than 260% year-over-year. The U.S. Senate’s approval of the GENIUS Act and the SEC’s updated guidance have accelerated both institutional and retail adoption. Companies such as Robinhood and Kraken have also added tokenized stocks.

Alchemy Pay aims to establish itself as a global financial access hub. In addition to its fiat-crypto gateway, it offers a digital bank for Web3 businesses, an NFT checkout solution with fiat payments, and ramp services for moving between crypto and fiat