As 2025 unfolds, the crypto market is showing sharp moves, influenced by token sales, institutional interest, and real-world adoption. Market participants are weighing factors such as technology, liquidity, and network activity. Comparing projects requires balancing short-term market conditions with longer-term execution risks.

In 2025, BlockDAG has drawn attention due to its ongoing token sale and reported ecosystem activity. XRP continues to be closely watched in relation to institutional interest and product developments. Monero remains notable for its privacy focus, while Stellar has highlighted institutional integrations and network usage. Together, these projects are frequently cited in discussions about major altcoins to track this year.

BlockDAG – Token sale activity and reported ecosystem metrics

According to BlockDAG’s project materials, it has raised more than $387 million and sold 25.7 billion coins across 30 batches as part of its token sale. The project has listed a token sale price of $0.03. Market price outcomes after any launch are uncertain, and any third-party price projections should be treated as speculative rather than predictive.

The project describes its design as a hybrid DAG + Proof-of-Work approach and claims throughput of up to 15,000 transactions per second. It also states it is EVM compatible, positioning this as a way for developers to deploy Ethereum-style applications. BlockDAG further reports that more than 4,500 developers are building over 300 projects in its ecosystem.

The project also reports adoption-related figures tied to its mining and hardware programs. It states the X1 mobile miner app has surpassed 3 million users, and that 19,500 X-Series miners have been sold worldwide, generating $7.8 million in hardware revenue. These figures are project-reported and may not be independently verified.BlockDAG has positioned these milestones as evidence of traction ahead of a broader market launch.

Overall, BlockDAG’s narrative in 2025 has centered on its architecture claims, developer tooling, and reported participation in its token sale and ecosystem programs.

XRP – Institutional interest and ETF-related discussion

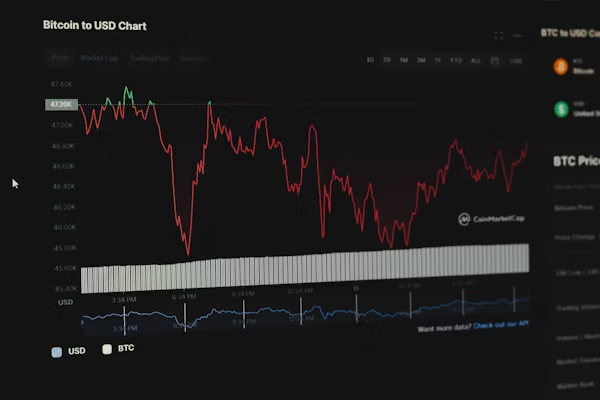

XRP is currently trading near $2.90, struggling to reclaim the $3 mark after recent selling pressure. The coin has been consolidating between $2.88 and $2.98, with support near $2.24 if it fails to hold. Any scenario involving moves toward higher price levels remains uncertain and depends on broader market conditions.

XRP remains widely followed by market participants tracking institutional activity. Ripple-linked funds reported $9.1 million in inflows this month, even as Coinbase cut its holdings by 57%. Discussion around potential ETF-related developments has also contributed to attention on the asset, alongside Ripple’s role in cross-border payments. Near-term volatility remains a risk.

Monero – Privacy focus and network concentration concerns

Monero (XMR) recently faced concerns when a mining pool controlled nearly 77% of the hashrate, raising security and decentralization questions. Kraken temporarily paused deposits as a precaution, while trading remained active. XMR later moved from about $231 to around $266–$273, with a reported support area near $269 and resistance referenced around $344.

The episode highlighted the ongoing trade-offs around privacy-focused networks, including regulatory scrutiny and operational risks. Developers have discussed upgrades such as ChainLocks and Seraphis aimed at strengthening security and privacy features. As with other cryptocurrencies, outcomes and timelines for upgrades can change.

Stellar – Institutional integrations and network usage indicators

Stellar (XLM) recently dipped from $0.43 to $0.40, with support near $0.378. Some market observers point to resistance levels that could be relevant if momentum returns, but price direction is uncertain. Separately, network indicators have been highlighted: active addresses are reported up nearly 50% to 494,000, stablecoin supply has reached $222 million, and over 100 million smart contract transactions have been processed.

Institutional activity has been cited as one contributor to attention on Stellar. Franklin Templeton tokenized $445 million in U.S. Treasuries on Stellar, while PayPal’s PYUSD stablecoin added additional payment-related use cases. The upcoming Protocol 23 upgrade is presented as improving transaction scalability and smart contract efficiency, though implementation details and impact depend on execution.

How these projects differ

These four projects emphasize different priorities: BlockDAG has focused on a fundraising-driven rollout and developer positioning, XRP is often discussed in the context of institutional flows and market structure, Monero is defined by its privacy model and related regulatory considerations, and Stellar highlights institutional integrations and network usage. Any comparison should account for differing maturity, liquidity profiles, and technical and regulatory risks.

References to BlockDAG as a leading candidate are based largely on its reported fundraising and ecosystem participation figures, which should be weighed against the uncertainties common to early-stage crypto projects. best altcoin to buy in 2025 and any discussion of future “multi-dollar valuations” should be understood as speculative.

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.