The cryptocurrency market is currently fragile. Bitcoin, the leading currency is fragile. Around this time last year, the crypto market was deep in red but market was in the early stages of a relieving reversal that saw BTC prices rally to $13,800 through to Q2 2019.

Price action is dull

Impressive, the Bitcoin market is back to the same doldrums. Given, fundamentals are pale. The trading community was expecting the US SEC to approve any of the eight Bitcoin ETF proposals but that didn’t materialize.

However, there was endorsement from the influential regulator that the coin was decentralized with no specific entity in complete control of the network’s hash rate.

Nonetheless, that was not enough for President Donald Trump to rip the crypto world, driving the narrative that cryptocurrencies are agent of money laundering and terrorist financing.

Of Libra and is Bitcoin running out of “Buy Steam”?

Towards that end, Libra, the stablecoin advanced by Facebook and several multibillion Wall Street behemoths may not see the light or its launch delayed beyond the said tentative date in H1 2020.

Libra, should it gain main stream attention and turn out to be a global currency that solves remittance allowing for a seamless transfer of value would highlight the benefits of Bitcoin, further cementing the coin’s position as the most trusted, secure and alternative of Gold.

Moving on, the market is apprehensive and the Euro Pacific Capital CEO Peter Schiff is of the view that Bitcoin—a project he’s adamant is a Ponzi—is running out of buyers and steam, judging from Google Search trends.

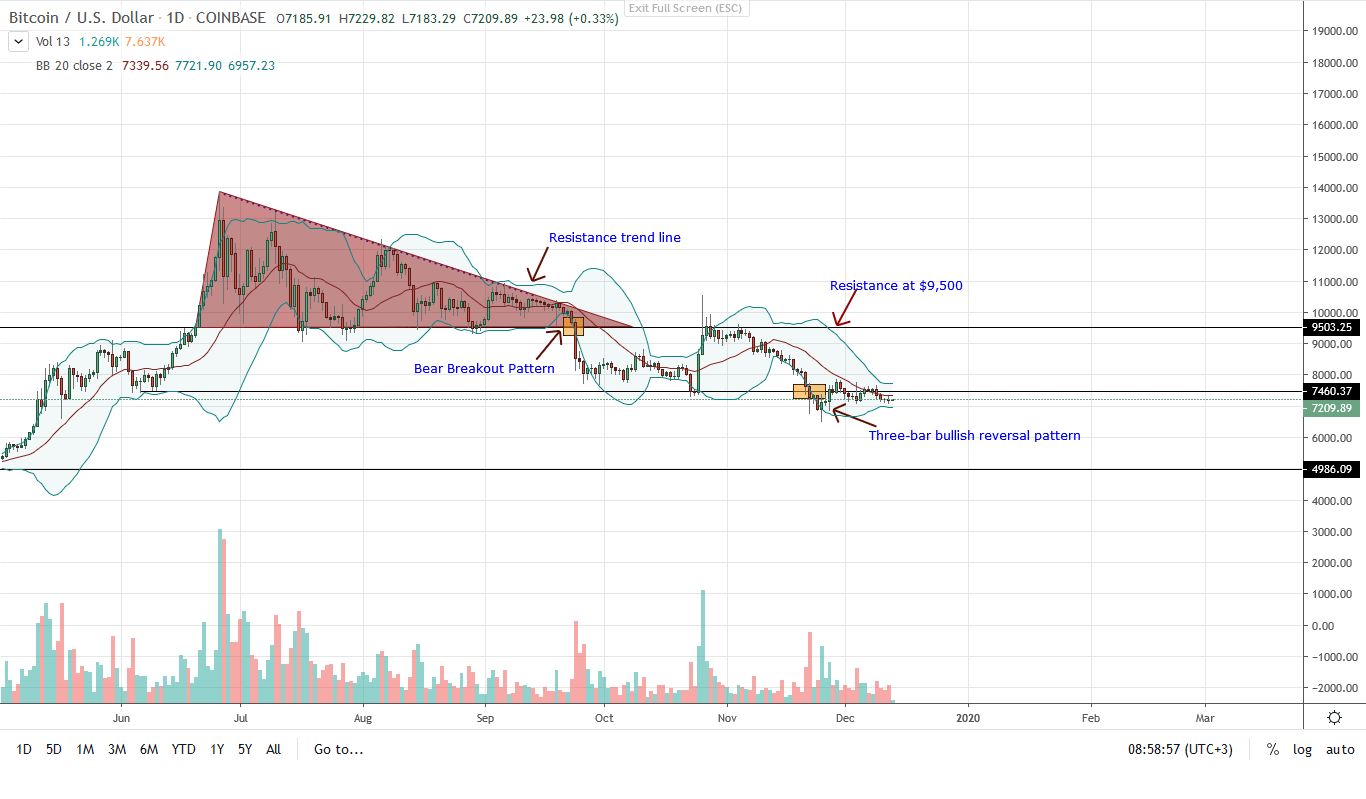

BTC/USD Price Analysis

Back to price action, BTC movements in the past week has been drub, eve boring. While it is encouragingly bullish that prices are trending above the $6,500-$7,000 support zone, trading volumes have tapered.

In the daily chart, bulls will only be in charge if there is a comprehensive break and close above the middle BB, or the flexible 20-day MA, at the back of high trading volumes preferably exceeding those of Nov 22.

Ideally, this will lift BTC prices above $8,000, confirming the three-bar bullish reversal pattern of Nov 24-27. If this turns out true, aggressive traders should buy the dips and aim for $9,500 as their first targets.

On the flip side, sharp losses below Nov 2019 lows accompanied with the same trading volumes could see BTC drop to $5,500-$6,000 in a retest of Q4-2018—Q1 2019 bullish breakout.

Chart courtesy of Trading View – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.