TL;DR

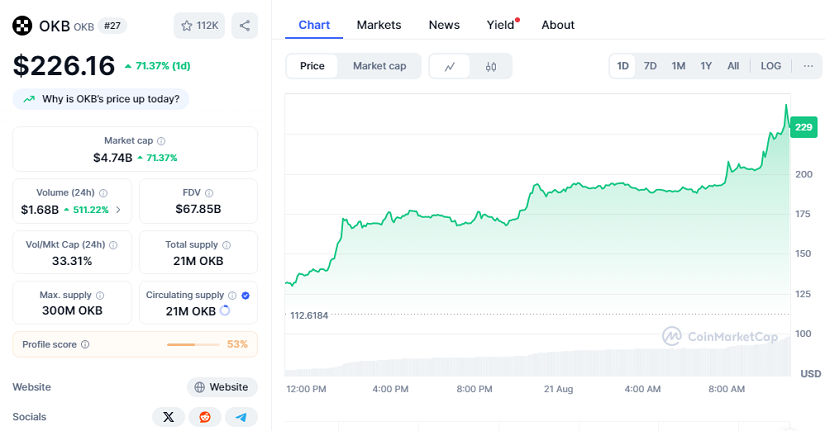

- OKB surged dramatically, reaching $226.16, driven by a massive token burn that slashed supply by 93%.

- The 24-hour gain of 71.37% and market capitalization of $4.74 billion reflect strong investor demand, while trading volume spiked 511% to $1.68 billion.

- Technical indicators like Aroon Up and Chaikin Money Flow confirm bullish momentum, though the Relative Strength Index signals that a short-term correction toward $142.88 could occur.

The crypto market has seen renewed enthusiasm today, with OKB leading the charge among major altcoins. The token, native to exchange OKX, jumped over 71% in the last 24 hours, hitting a record $226.16 at press time. Its market capitalization now stands at $4.74 billion, supported by a surge in 24-hour trading volume of $1.68 billion, an increase of more than fivefold. Investors and analysts alike are highlighting the token’s impressive liquidity and broad adoption across trading platforms, which continues to attract institutional attention and reinforce its strong market position.

Token Burn Sparks Unprecedented Investor Interest

The recent 93% reduction in OKB’s circulating supply appears to have intensified buying activity, driving the token toward new all-time highs. Analysts note that technical indicators reinforce this bullish trend. OKB’s Aroon Up line remains at 100%, signaling a strong upward trend supported by persistent investor capital inflows. Chaikin Money Flow also sits at a three-month high, reflecting continuous accumulation by traders and institutions alike. Increased interest from global markets, including Asia and Europe, has contributed to heightened demand, boosting trading volumes and investor confidence even further.

The combination of these indicators suggests that OKB could continue climbing if investor momentum remains strong. Market observers emphasize that the token’s aggressive supply burn has created scarcity, which historically tends to amplify upward price movements in the crypto sector.

Overbought Signals Highlight Possible Short-Term Correction

Despite the excitement, caution is warranted. The Relative Strength Index for OKB currently reads 92.66, indicating overbought conditions. This suggests a potential pullback in the near term, with analysts projecting a possible correction toward $142.88 if buying pressure eases. Overbought RSI levels often signal temporary exhaustion in the market, even during strong bull runs. Traders are advised to monitor key support levels closely while observing ongoing capital inflows and market sentiment.

Investors are closely monitoring OKB’s performance following the supply burn and record trading volumes. While some expect the rally to continue, others advise careful observation of momentum indicators to anticipate any near-term retracement. The token’s recent gains reinforce its status as one of the most actively traded and closely watched assets in the crypto ecosystem today.