TL;DR

- An ETH trader turned $125,000 into more than $43M in four months, but a liquidation on Hyperliquid left him with only $771,000 after losing $6.2M.

- James Wynn also suffered a partial liquidation and now holds a $300,000 position at risk of being wiped out if ETH drops below $4,113.

- Three large wallets sold $147M in ETH, while others took advantage of the dip to buy over $25M.

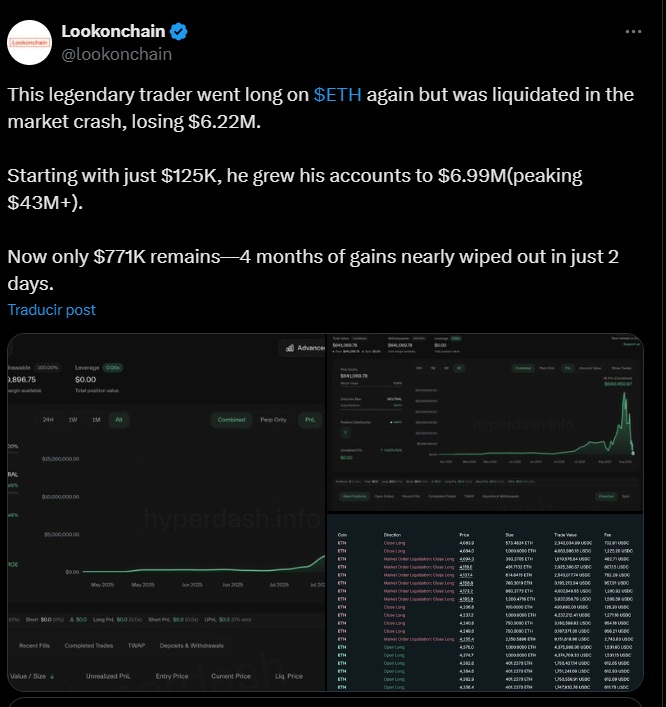

An Ethereum trader went through one of the most extreme stories the crypto market’s volatility has produced. In just four months, he grew an initial account of $125,000 into more than $43 million. However, that run came to an abrupt end this week when ETH’s drop toward $4,000 triggered a liquidation on the Hyperliquid DEX that erased nearly all his gains. After securing around $7 million earlier in the week, the account suffered a $6.2 million loss within hours and was left with $771,000.

Tough Day for Traders

The situation did not only affect this trader. James Wynn, well known for his activity in leveraged markets, also saw his exposure cut down. His long ETH positions were partially liquidated, and he now holds a $300,000 balance that could disappear if the cryptocurrency’s price falls below $4,113. Wynn said he is fully invested with no stablecoins left, and warned he will have to adjust his lifestyle if the altcoin recovery he expects does not arrive.

Ethereum’s largest wallets also reacted quickly to the market pullback. Three well-known addresses collectively liquidated $147 million in ETH, with individual sales of $77 million, $57 million, and $12 million. That selling pressure added to the market’s fragility at the time.

Buy the Dip

Other investors viewed the drop as a buying opportunity. An address identified by Nansen as one of the top 100 traders acquired $3.4 million worth of ETH, while two other wallets bought $3.16 million and $2.9 million respectively. Even the wallet linked to the Radiant Capital exploit reemerged with purchases worth $16.6 million, showing that some players with deep liquidity used the lower prices to accumulate.

The market’s focus now turns to Jerome Powell’s upcoming monetary policy remarks at Jackson Hole. Analysts from investment platforms argue that the next big swings in crypto could depend more on signals from the Federal Reserve than on technical charts