TL;DR

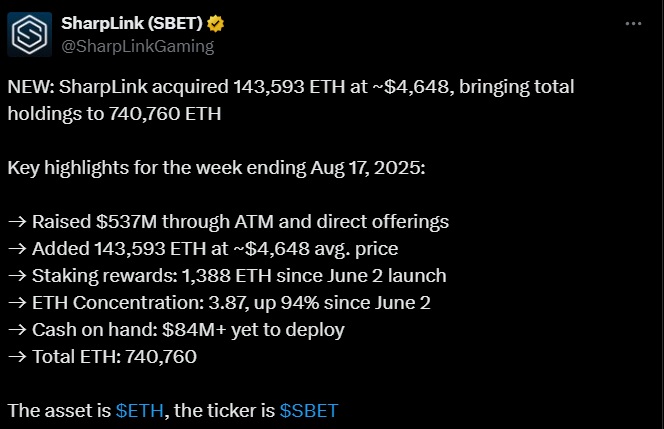

- SharpLink purchased 143,593 ETH for $667.4 million, raising its holdings to 740,760 ETH valued at $3.2 billion.

- The company generated 1,388 ETH in staking rewards, deploying a significant portion of its holdings in validation, including liquid staking.

- After a quarter with a net loss of $103 million, the firm’s shares dropped 12%.

SharpLink acquired 143,593 ETH for $667.4 million at an average price of $4,648 per token, increasing its treasury to 740,760 ETH, worth approximately $3.2 billion. The purchase occurred as Ethereum approached levels near its all-time high.

The company also reported 1,388 ETH in staking rewards, confirming that much of its holdings are actively validating, including positions through liquid staking. SharpLink warned that certain staking activities may be subject to regulatory changes and acknowledged the possibility of adjustments that could affect its operations.

The transaction comes after a quarter with a net loss of $103 million. SharpLink attributed part of this result to accounting effects related to liquid staking. The combination of aggressive ETH accumulation and accounting losses highlights the tension between a cryptocurrency treasury strategy and the demands of financial accounting.

SharpLink Faces Market Setback

The market reaction was negative. Shares fell 12% on the Friday following the announcement and closed at $20.10 on Monday, marking a 13.5% decline over five trading sessions. This movement indicates that investors weigh both the consolidation of Ethereum holdings and the risks related to valuation and liquidity of the underlying assets.

The purchase coincides with strong inflows of institutional capital into Ethereum. Spot ETH ETF issuers recorded $3.7 billion in inflows recently, while rivals like BitMine increased their treasuries with large purchases, reaching 1.52 million ETH, worth around $6.6 billion. There is clear competition among major institutional firms to control significant positions in ETH.

SharpLink also operates businesses linked to Ethereum network infrastructure. The firm uses part of its inventory to generate revenue through block validation and technical services related to validators.

The decision to acquire large amounts of ETH at high prices reflects a bet on the long-term appreciation of the cryptocurrency