TL;DR

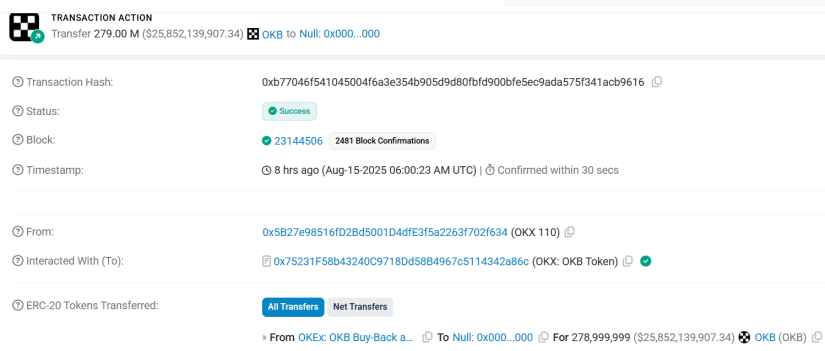

- OKX permanently burned 278,999,999 OKB worth over $26 billion, reducing the total supply to just 21 million tokens.

- The tokenomics update removes minting and manual burns through a new smart contract.

- The exchange will shut down OKTChain on January 1, 2026, and has already converted OKT to OKB using an average price-based exchange rate.

OKX drastically reduced the supply of its native token, OKB, after carrying out a permanent burn of 278,999,999 units worth over $26 billion at current market prices.

OKX: Tokenomics Overhaul

The decision is part of a complete restructuring of the token’s economic model, announced by the company days earlier. With this move, the total supply of OKB dropped from 300 million to just 21 million tokens, making it one of the steepest supply cuts ever implemented by a centralized exchange.

Some of the burned tokens came from previous buyback programs and had been held in corporate reserves. In total, the reduction included around 65.26 million OKB acquired through these programs, showing that the company used assets already under its control to execute most of the burn. The tokenomics redesign also involves a change to OKB’s smart contract, removing the ability to mint new tokens or conduct manual burns, effectively locking the supply.

The announcement also included another major decision: the permanent closure of OKTChain, the blockchain developed by OKX. Although it will no longer receive support, it will remain operational until January 1, 2026, to facilitate the transition. OKT holders have already had their tokens converted to OKB, with the exchange rate calculated using the average closing prices between July 13 and August 12. This process aimed to simplify the product structure and consolidate activity around a single token.

How Did the Burn Affect OKB’s Price?

The market reaction was immediate. Following the news, OKB’s price climbed above $120 per token but later pulled back by nearly 7% to around $93. Industry analysts attribute the volatility to some investors responding to the sharp supply reduction, while others believe the market may have overestimated the actual circulating supply before the announcement.

OKB’s current on-chain market capitalization stands at roughly $2 billion. The new scenario, with a fixed supply and the removal of minting mechanisms, creates a structural shift in the token’s dynamics and could reshape its performance in the coming months, particularly in terms of liquidity and its role within the OKX ecosystem