TL;DR

- Vitalik Buterin proposes using zero-knowledge proofs to speed up withdrawals on Layer 2 networks, aiming to reduce them to 12 seconds.

- The measure seeks to lower capital costs for liquidity providers and improve Ethereum’s operational efficiency.

- Higher speed must not compromise network security.

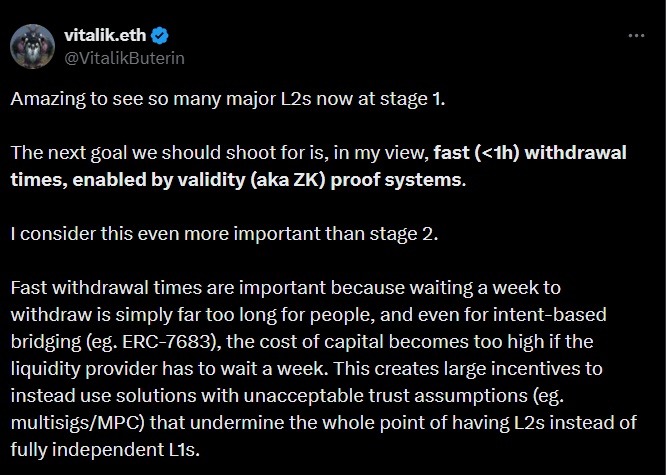

Vitalik Buterin has proposed accelerating withdrawals on Ethereum’s Layer 2 networks through the implementation of zero-knowledge proofs.

He aims to replace the current system based on optimistic proofs to shorten waiting times and improve the user experience when moving assets between layers. If the goal of reducing withdrawals to under one hour in the short term and to 12 seconds in the medium term is achieved, Ethereum could strengthen its position as the primary infrastructure for digital asset issuance.

The proposal also seeks to lower capital costs for liquidity providers by eliminating the need to lock up funds for extended periods. For users, shorter withdrawal times offer a direct improvement in day-to-day network usability. For developers working on decentralized financial applications, it opens up new possibilities to design more efficient products.

Buterin: Higher Speed Must Not Compromise Security

The proposal aligns with Ethereum’s recent growth and the increasing adoption of Layer 2 solutions, which continue to accumulate more volume and demand. Buterin emphasizes that higher speed must not come at the expense of network security, making it necessary to design mechanisms that uphold the same level of trust as the mainnet.

This balance between speed and security is generating technical discussions among developers, who generally view the move toward zero-knowledge proofs as a positive shift and a new potential standard.

These cryptographic proofs are already being used in some projects, but their widespread adoption for withdrawals would mark a structural change in how the ecosystem operates. It would also improve interoperability among various scaling solutions and solidify ETH’s role as the economic center of the system, not just as the underlying infrastructure.

Ethereum is currently trading at around $3,644, up 77% over the past 90 days. Its market capitalization stands at $439.91 billion, with an 11.72% share of the total crypto market. Despite a daily volume drop of over 24%, structural interest in ETH remains strong.