TL;DR

- The tokenized stock market surged 220% in July, reaching a market capitalization of $370 million, with over 90,000 active addresses.

- Interest is focused on stocks like Tesla and Amazon, which are now traded 24/7 on exchanges like Kraken and Backed Finance, with no fees or transfer restrictions.

- ETH led the month’s gains with a 50% increase, while companies added over 2.7 million ETH to their corporate treasuries.

The tokenized stock market saw a sharp rise in July, reaching a total capitalization of $370 million.

Most of that value came from Exodus Movement shares, issued through Securitize. Excluding that single issuance, the rest of the market grew from $16.7 million to $53.6 million, a 220% jump in just one month.

A Market That Recalls the 2020–2021 DeFi Boom

The number of active addresses also multiplied, rising from 1,600 to over 90,000. This rapid expansion mirrors the growth pace of DeFi between 2020 and 2021, reinforcing the idea of exponential adoption of blockchain-based financial products.

Investor demand is concentrated in high-profile stocks like Tesla, Apple, Amazon, and Microsoft, which are now available on platforms like Kraken, Bybit, and Backed Finance within Solana’s DeFi ecosystem. These tokenized versions offer 24/7 trading, zero fees, and full wallet-to-wallet transferability—features that are still out of reach in traditional markets.

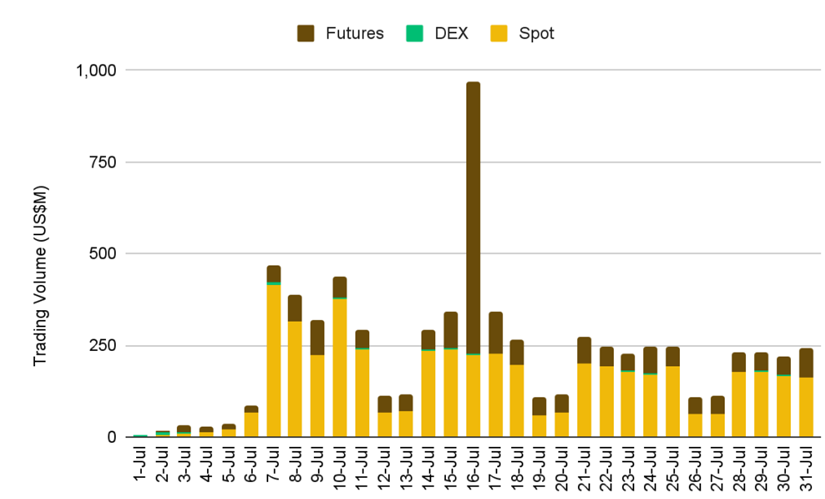

Although trading volumes remain concentrated on centralized platforms, the potential for expansion is considerable. If just 1% of the global equity market were tokenized, the segment could exceed $1.3 trillion in capitalization.

Capital Flows and New Regulations

At the same time, July marked a strong wave of institutional capital into crypto. ETH was the best-performing large-cap asset of the month, climbing 50%. Companies that added ETH to their balance sheets now hold over 2.7 million ETH, drawn by staking yields and its deflationary model. These new corporate holdings already account for nearly half of all ETH held in ETFs.

The U.S. regulatory framework also progressed. Congress passed the GENIUS Act, establishing a federal standard for stablecoins backed 1:1 by cash or short-term Treasuries, with AML compliance requirements. This framework accelerated pilots for tokenized deposits by JPMorgan and Citi, and prompted Visa to expand stablecoin integration. Since late 2024, on-chain stablecoin transfers have consistently outpaced Visa’s volumes, solidifying their role in global payments