TL;DR

- XRP and Ethereum are leading a fresh crypto rebound after a difficult week dominated by Trump’s revived trade tensions.

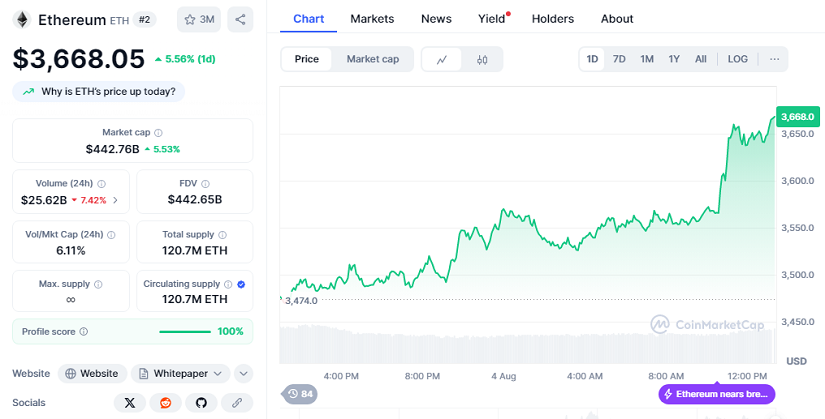

- Ethereum is trading at $3,668.05 with a 5.56% daily increase and a market cap of $442.76 billion.

- XRP follows closely at $3.05, up 5.68% in the last 24 hours, pushing its market cap to $181.27 billion as altcoins show clear resilience.

After days of losses triggered by renewed global trade tensions, major altcoins are showing fresh momentum, led by XRP and Ethereum. Both tokens have posted strong gains in the past 24 hours, hinting at renewed investor confidence despite the market’s recent dip. Last Thursday, President Donald Trump reimposed tariffs on dozens of trade partners, sending shockwaves through equities and commodities alike. The S&P 500 dropped over 3% in response, and crypto followed before finding its footing again over the weekend.

According to CoinMarketCap data, Ethereum has risen 5.56% in the last 24 hours and now trades at $3,668.05. Its market capitalization stands at $442.76 billion, narrowing its gap to its historic high. XRP has also gained 5.68% to reach $3.05, pushing its total market cap to $181.27 billion. These figures reinforce speculation about an XRP ETF approval, which now has a 64% probability over Litecoin’s chances, according to Myriad Markets.

Altcoins Climb As Investors Watch New Highs

While Bitcoin, BNB, and Solana traded mostly flat, other altcoins made gains. Ethena, the Ethereum-based DeFi stablecoin protocol, jumped 10.8% over the past day. Stellar followed with an 8.1% climb, while Injective surged 5.9% and Solana’s meme token BONK rose by 5%. These gains suggest investors are diversifying beyond Bitcoin, hunting for value in smaller but promising projects.

Despite the daily charts turning green, most of these tokens remain lower than last week’s levels. The global crypto market cap has edged up by nearly 1% in the past day, signaling that the rebound may still be fragile if macroeconomic pressures persist.

Trump’s Tariffs Stir Markets, But Crypto Eyes Recovery

The revival of Trump’s trade war with tariffs ranging from 10% to 41% on key partners like China, Canada, the EU, and Mexico caught markets off guard. Bitcoin and Ethereum initially slipped alongside major stocks but have recovered faster than expected. Many traders see this as a sign that crypto assets may again serve as a hedge when geopolitical uncertainty rattles traditional finance.

Looking ahead, traders are watching any sign of progress on a possible XRP ETF, while tracking Ethereum’s push toward its all-time high of nearly $4,900.