TL;DR

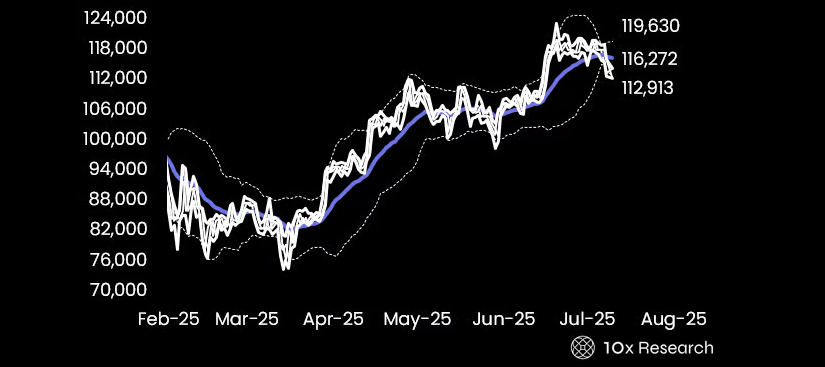

- Bitcoin is trading around $114,240 after briefly falling under $112,000, with 10x Research highlighting a stealth factor that could spark a sharp price reversal.

- August’s historical weakness mirrors last year’s drop, which turned around after the Fed’s unexpected rate cut.

- Analysts argue that overlooked macro trends and technical levels might trigger one of BTC’s strongest rebounds if current signals align soon enough.

After a challenging start to August, Bitcoin appears poised for what could become one of its most significant recoveries in recent months. According to fresh insights from 10x Research, the world’s largest cryptocurrency is showing signs of reversing its recent slide, helped by an under-the-radar factor the market may be ignoring.

10x Research pointed out that while traders fixate on labor market data and potential rate adjustments, an overlooked catalyst is quietly gathering strength. The firm explained that a blend of technical levels converging with subtle macroeconomic shifts could ignite renewed momentum for Bitcoin’s price. Currently hovering near $114,240, BTC remains above key support zones, which some analysts see as an encouraging technical sign.

Historical Trends Suggest August Weakness Could Flip

The report compares today’s environment to last year’s pattern, where Bitcoin endured a typical August correction only to stage a powerful rebound later. Historically, August has been one of Bitcoin’s weakest months, often posting drops between five and twenty percent. In 2024, the Federal Reserve surprised markets by cutting rates by 50 basis points in September, giving crypto markets a fresh boost and renewed confidence.

A similar setup could be unfolding now. The Fed recently left rates unchanged at 4.25%–4.5% but signaled openness to further easing if labor data keeps softening. This has fueled optimism that any deepening slowdown in the labor market could trigger more accommodative monetary policy, providing a supportive backdrop for Bitcoin.

Long-Term Outlook Remains Strong Despite Short-Term Shifts

Despite this year’s volatile swings, Bitcoin’s resilience has impressed veteran observers worldwide. Gadi Chait, Head of Investment at Xapo Bank, emphasized that Bitcoin has matured significantly, withstanding macro shocks that might have once caused deeper sell-offs. He added that short-term pullbacks have done little to dent the growing belief in Bitcoin as a reliable long-term asset.

Some traders are now watching whether a clear rate cut signal could serve as the “stealth trigger” 10x Research flagged. If so, the coming weeks may bring renewed buying momentum, echoing last year’s powerful comeback and reminding investors that Bitcoin still holds surprises when least expected.