Not Everyone Love Ripple

There is no doubt that XRP, despite standing out like a sore thumb as one of the most liquid cryptocurrency in the top 10, is attracting investment. The community is split on whether or not XRP is a true cryptocurrency and is decentralized enough with no central control.

Perhaps the reason around this could be Ripple Inc.’s majority ownership that sparked several class action suit from aggrieved investors complaining that they had lost a bunch because of Brad Garlinghouse’s and team marketing.

Although Ripple Labs, the official issuers of XRP, have asked a US Federal court to throw out these lawsuits, there remains a lot of PR to be done for XRP to be welcomed in some quarters of the blockchain and crypto community with open arms.

MoneyGram wants more Payment Corridors

Even so, XRP coin owners are upbeat, expecting prices to soar in days ahead.

Confidence stems from MoneyGram’s xRapid integration and recent news that their CEO, Alexander Holmes, is urging the Ripple Inc. team to open up more payment corridors.

Obviously, the more the payment corridors, the more the customers and that means demand for the coin. The more the demand, the higher the prices-and that’s just economics.

Unless of course it emerges that Ripple will, as some critics pointed out, will deliberately keep the prices of XRP down by dumping more coins from their vault, and satisfying banks and processors that leverage the coin in their operations.

XRP/USD Price Analysis

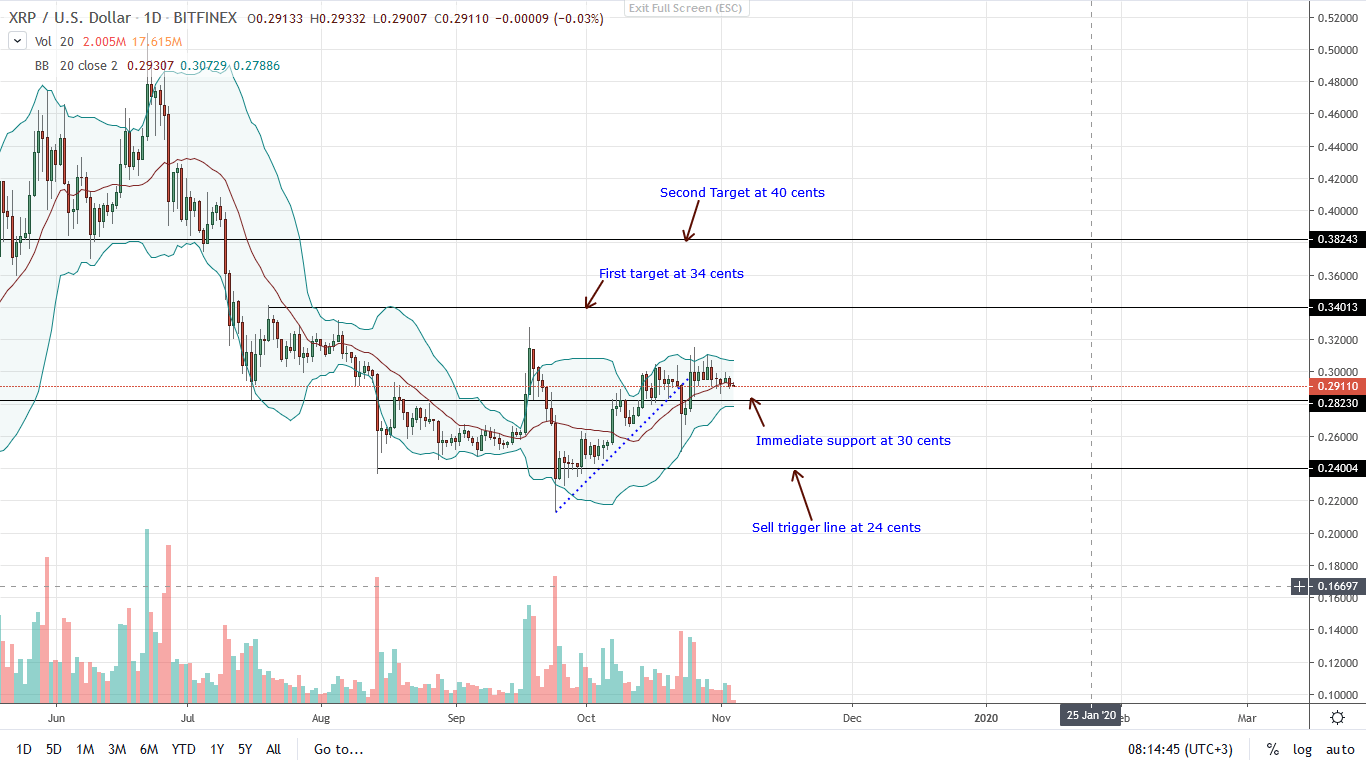

XRP prices are relatively stable, consolidating against BTC, USD and ETH. Despite the range mode, buyers are in control.

Behind this reasoning is the failure of bears to reverse sharp gains of Oct 25. The candlestick is conspicuously bullish and backed by high trading volumes.

From an effort versus result point of view, buyers are in control as long as prices are capped inside the bar’s trade range.

As such, every low above the 28-30 cents immediate support line should be a buying opportunity for risk-off traders aiming for 34 cents and 40 cents.

From previous XRP/USD analysis, the best course of action for risk-averse traders is to wait for a breach and close above 34 cents or Oct 25 highs before loading up the dips with targets at 40 cents and later 55 cents.

All this depends on the strength of buyers gauged by participation levels.

Any lift off above 34 or 40 cents resistance levels marked by high trading volumes exceeding $50 million or those of Aug 14 could spark a resurgence as XRP prices soar to 55 cents and even 80 cents of Q3 2018.

On the flip side, losses below 24-25 cents support will invalidate this bullish overview.

Chart courtesy of TradingView-Bitfinex

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.

![Ripple [XRP] Ranges and is Bearish despite being ranked in the same league as Tesla](https://crypto-economy.com//wp-content/uploads/2019/11/xrp-price-ripple-1024x577.jpg)