TL;DR

- Bitcoin hit a new all-time high of $118,000, but the options market signals caution with a Put/Call ratio of 1.06.

- Deribit places the “max pain” point at $108,000, while the rise in bearish contracts and extreme leverage increases technical pressure in derivatives.

- The spot market remains solid, although the gap between bullish spot sentiment and bearish option expectations hints at a potential correction or short squeeze.

Bitcoin reached a new all-time high of $118,000 today, but the derivatives market has started flashing multiple warning signals.

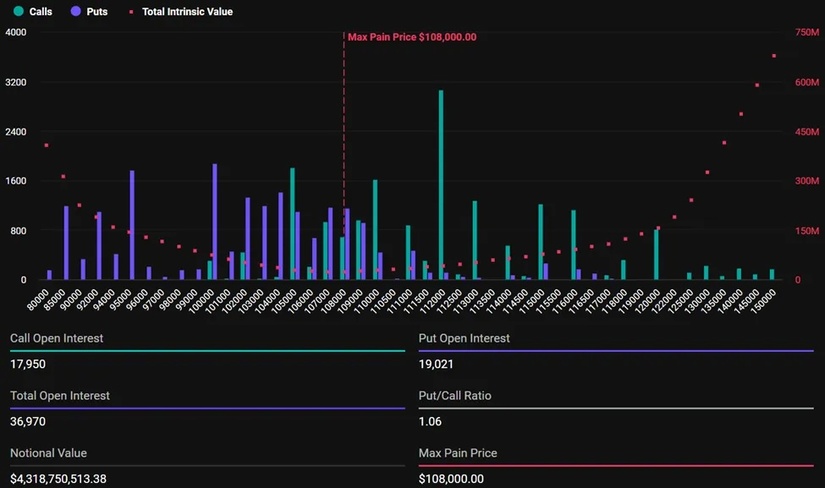

Options expiring today have a notional value of $4.3 billion and hold a Put/Call ratio of 1.06. This indicates a higher number of put (sell) contracts in circulation compared to calls (buy), suggesting that a significant portion of traders expects a pullback in the coming days.

Data from Deribit places the “max pain” point at $108,000 — the level at which the largest number of option buyers would lose capital at expiry. This figure is key because it establishes a pressure point for the market as expiry approaches, potentially shaping short-term price action.

Meanwhile, derivatives analytics platforms are noting a surge in extreme leverage. Greeks.Live reported trades with margins up to 500x — a strategy that multiplies risk in a highly volatile environment. Although these positions represent a minority, their very existence reflects the speculative tone dominating the market. Despite repeated warnings, aggressive strategies aiming to capture quick moves continue to emerge, amplifying both potential gains and losses.

A Divided Market: Overbought and Prepping for a Pullback

The spot market shows resilience, but the disparity between the optimism of spot traders and the caution evident in options reveals a divided landscape. The rise of the Put/Call ratio above 1 aligns with previous overbought episodes, where options acted as hedges against corrections after price rallies.

The buildup of open interest at elevated levels and the concentration of bearish positions create a technically tense scenario. If Bitcoin extends its rally, these derivatives could trigger forced short liquidations. If instead the price retreats, the leverage exposure of traders could heighten volatility.

The market faces a decisive moment, where the excitement of record highs coexists with technical signals urging caution. The next few days will determine whether bullish momentum continues or if positions get adjusted ahead of a new consolidation phase.