TL;DR

- Ripple has applied for a national banking license in the U.S. to operate its RLUSD stablecoin under federal supervision and expand its reach.

- The company aims to turn RLUSD into a dual-regulated stablecoin, enhancing transparency and offering additional safeguards for users and institutions.

- Ripple plans to use this license to launch new crypto financial services and narrow the gap between traditional banking and digital assets.

Ripple has filed an application for a national banking license in the United States with the Office of the Comptroller of the Currency (OCC), seeking federal-level regulation that would allow it to operate beyond state restrictions. The company wants its stablecoin, RLUSD — currently overseen by New York regulators — to be brought under federal supervision, which would offer greater clarity and strengthen market confidence.

RLUSD is a U.S. dollar-pegged stablecoin backed by reserves including cash and short-term Treasury bills. Federal oversight would reinforce transparency and risk management, benefiting both users and regulators, according to Jack McDonald, Ripple’s Senior Vice President of Stablecoins. This dual regulatory framework could become a reference model for crypto compliance going forward.

Governments worldwide have tightened scrutiny over crypto markets, increasing regulatory attention on various digital assets born within the industry. Ripple intends to leverage the banking license to expand its services beyond cross-border payments, exploring new crypto-based financial products.

A License for Ripple That Could Reshape the Financial System

Securing a national license would not only let Ripple operate across multiple states with ease but could also usher in a new phase for the traditional financial system. The company would actively work on developing products aimed at narrowing the gap between crypto and conventional banking, integrating blockchain technology into fully regulated, properly supervised financial services.

It would also be a critical move to bring stronger legal certainty to stablecoins and broaden their acceptance within regulated markets. The San Francisco-based firm hopes to solidify its status as a bridge between digital and traditional finance.

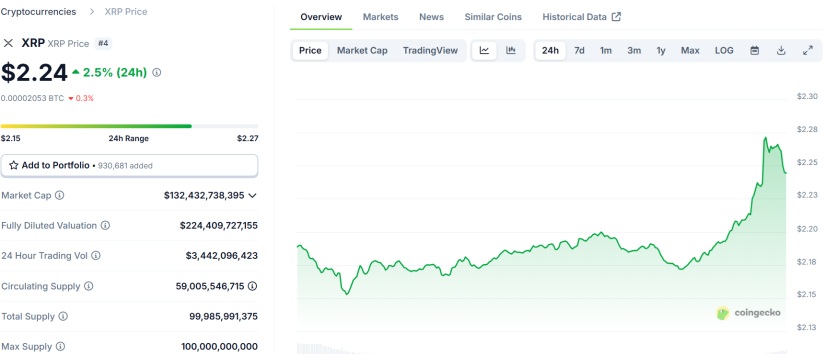

According to the latest CoinGecko data, XRP, Ripple’s native token, is currently trading at $2.24 per unit, up 2.3% in the last 24 hours. Its market capitalization exceeds $132 billion, while its 24-hour trading volume stands above $3.4 billion, though it has fallen 19% compared to the previous day.