TL;DR

- Polkadot’s Diversification Strategy: The proposal suggests converting 500,000 DOT into tokenized Bitcoin (tBTC) to hedge against market volatility and strengthen the treasury.

- Measured Conversion Approach: Utilizing a rolling dollar-cost averaging method with 1,000 DOT reserved for fees, the strategy aims to minimize price fluctuations during the conversion process.

- Enhanced Efficiency and Resilience: By integrating yield-bearing collateral tokens and deploying tBTC as liquidity within a non-custodial framework, the initiative seeks to boost capital efficiency.

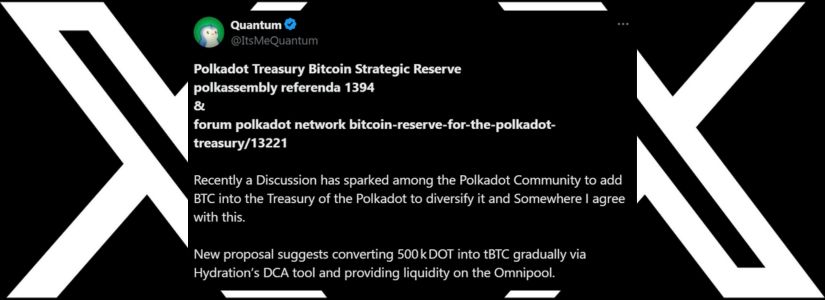

Polkadot community members have put forward an innovative proposal to diversify the network’s treasury by creating a Bitcoin reserve. Aiming to hedge against volatility and ensure long-term financial resilience, the proposal recommends converting 500,000 DOT tokens into tokenized Bitcoin (tBTC) over the next year.

Proposal Overview

The proposal, inspired by recent talks in Polkadot forums, aims to enhance the treasury’s stability by diversifying. Community members believe that creating a Bitcoin reserve will help Polkadot safeguard its ecosystem from market fluctuations and demonstrate a dedication to a multi-chain future.

This measured approach emphasizes risk management over speculation, aiming to secure funds for vital ecosystem development projects during turbulent cycles.

Methodology and Mechanism

The proposal centers around Hydration’s rolling dollar-cost averaging (DCA) method. Rather than making a single swap, the strategy is to slowly convert DOT to tBTC, which helps to reduce price volatility.

Additionally, 1,000 DOT tokens are set aside to pay for transaction fees throughout the conversion. The tBTC acquired will be used later as liquidity in the Hydration Omnipool, using Threshold Network’s non-custodial solution to ensure decentralization, transparency, and security.

Risk Management and Yield Potential

By shifting a portion of its treasury into a Bitcoin reserve, Polkadot aims to reduce the inherent risks faced by a concentrated asset portfolio. The proposal also takes an innovative approach to maximize capital efficiency: the full amount of DOT will first be converted into a yield-bearing collateral token, which is then supplied to the Hydration Borrow feature.

This not only earns yield on dormant DOT assets but also increases the supply available for borrowing, supporting additional DeFi use cases. Proponents claim that similar diversification efforts in other ecosystems, like the Ethereum Foundation, have proven successful in managing risk.

Community Response and Future Steps

Although still under discussion, the community’s feedback has been active and largely positive. Members emphasize that this strategy is about ensuring operational continuity, rather than chasing market timing. The proposal is anticipated to get on-chain soon after further deliberations, potentially adding a new layer of resilience to the Polkadot Treasury and setting an industry benchmark for risk-managed treasury diversification.