TL;DR

- Bitcoin delivered extraordinary returns in every global monetary expansion cycle, driven by excess market liquidity.

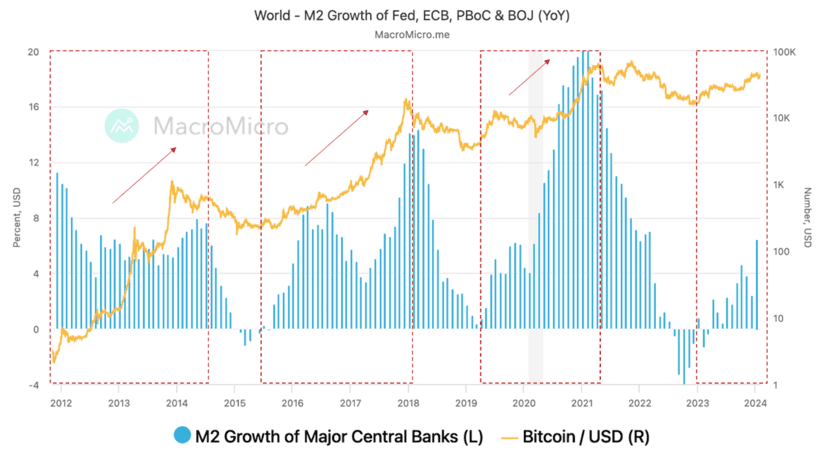

- The correlation between M2 money supply and BTC price confirms that money flows condition the appetite for speculative assets.

- With over 65% of central banks projecting rate cuts in 2024, a favorable environment for a sustained Bitcoin recovery is anticipated.

The relationship between Bitcoin and global money supply has long been one of the least explored macroeconomic links. Yet over the past decade, it has revealed a systematic and consistent correlation. When analyzing BTC’s bullish and bearish cycles since its creation, it becomes evident that its strongest rallies have coincided with phases of monetary expansion driven by major central banks. Understanding this dynamic helps interpret crypto market movements in periods of loose monetary policy and anticipate potential scenarios for the coming quarters.

Money Supply and Global Liquidity Expansion

The M2 money supply includes cash in circulation, checking accounts, savings deposits, money market funds, and time deposits under $100,000. Alongside M1 and M3, it’s one of the main variables central banks use to measure and control the money available in their economies.

Over the past 15 years, events like the 2008 financial crisis, the European Central Bank’s expansive monetary policy in 2016, and the coordinated response of major central banks to the 2020 pandemic led to significant increases in global liquidity.

These monetary expansions — characterized by interest rate cuts and asset purchase programs — were designed to stabilize markets and support economic growth. However, their collateral effects also reached other assets, including cryptocurrencies.

Bitcoin: Programmed Scarcity vs Unlimited Expansion

Bitcoin’s key attribute is its limited and predictable supply: a maximum of 21 million units, released at a decreasing rate through a halving process every four years. Conceptually, this positions it closer to monetary commodities like gold than to fiat currencies, whose issuance depends on the discretionary policy of central banks.

Whenever significant monetary expansion occurs, excess liquidity tends to flow into scarce assets. In this sense, Bitcoin operates as a speculative store of value, appreciating in environments of abundant liquidity and losing momentum when liquidity tightens. Historical data shows that BTC posted extraordinary positive returns during periods when global M2 money supply grew above its historical average.

Empirical Evidence of the Bitcoin–M2 Correlation

Several studies analyzing the balance sheets of the 21 main monetary authorities confirm this relationship. Bitcoin recorded substantial rallies after the Federal Reserve’s monetary expansion in 2008, during the ECB’s stimulus phase in 2016, and especially following the Fed’s 73% balance sheet increase in 2020. In contrast, its sharpest declines coincided with monetary tightening processes, such as the end of the Fed’s asset purchase programs and rate hikes starting in late 2021.

This correlation does not imply direct causation, but it clearly reveals that the relative abundance or scarcity of money in the markets conditions the appetite for risk and speculative assets like cryptocurrencies.

Outlook for 2024–2025: A New Expansion Cycle

Looking ahead to the coming quarters, over 65% of central banks worldwide plan to cut interest rates in 2024, with a strong likelihood of extending this cycle into 2025. This shift in monetary policy aims to support economic activity amid slowing global growth and the gradual control of inflation rates.

If historical patterns hold, a new increase in the M2 money supply could create favorable conditions for a sustained recovery in Bitcoin and the broader crypto market. The performance of cryptocurrencies will once again depend on their appeal as a hedge against fiat currency depreciation and as scarce assets in the context of monetary expansion.

Conclusion

The relationship between global money supply expansion and Bitcoin prices stands as one of the most relevant macroeconomic variables for understanding its appreciation cycles. While factors such as regulation, institutional adoption, and technology also influence cryptocurrency prices, M2 behavior remains a key indicator. In a context of foreseeable monetary easing, closely monitoring this variable is essential to anticipate potential market scenarios for Bitcoin