TL;DR

- Safe launches Labs, a new division focused on developing enterprise-grade self-custody solutions based on its Smart Accounts system.

- The company manages $60 billion in assets and processes 4% of all Ethereum transactions, with strong institutional adoption.

- One of its main goals is to reduce reliance on blind signing, a practice that exposes companies to critical risks when handling complex transactions.

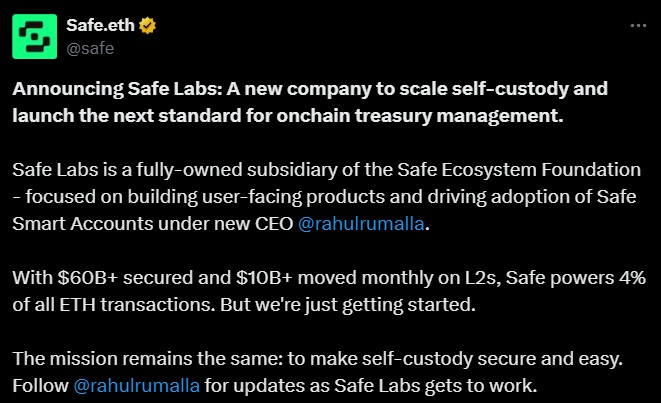

Safe, the firm specializing in self-custody solutions for digital assets, announced the creation of Labs, a new unit dedicated to building enterprise-grade products.

This subsidiary will operate independently, though under the full control of Safe, and will focus its work on tools built on Smart Accounts — a modular smart contract-based wallet system.

The launch responds to growing demand from companies that manage or handle on-chain assets for their clients. According to Rahul Rumalla, who will lead the new division after serving as the company’s Chief Product Officer, numerous institutions have already been operating on Safe’s infrastructure for years. The new division will allow the company to deliver more tailored solutions designed for these users’ specific needs.

Safe’s Weight in the Crypto Industry

Today, Safe manages $60 billion in assets, processes 4% of all Ethereum transactions, and controls nearly 10% of the smart account market on the Ethereum Virtual Machine. These numbers have positioned it as one of the most important providers of smart contract-based self-custody infrastructure.

A major challenge for the institutional ecosystem remains the secure management of complex transactions. Many multisignature setups still rely on blind signing — a process that forces transactions to be approved from hardware wallets without being able to fully verify their details on the device’s screen. This severe limitation puts firms at risk, as evidenced by the $1.4 billion Bybit hack in February, which was attributed to this very practice.

Blind Signing: Blank Checks Online

Addressing this security issue requires collaboration between multisignature solution developers and hardware wallet manufacturers. Ledger and Trezor, two of the industry’s top providers, have acknowledged the need to move forward on this front. Pascal Gauthier, CEO of Ledger, called blind signing an unacceptable risk, comparing it to signing blank checks online.

Safe Labs will continue building on its Smart Accounts infrastructure, which enables multisignature management but still requires blind approvals for certain operations. The challenge ahead lies in reducing that dependency and raising security standards for institutional users