TL;DR

- Ethereum led digital asset investments with $321 million in weekly inflows, marking its best performance since December 2024.

- Meanwhile, Bitcoin ended the week with $8 million in outflows, breaking a six-week streak of gains.

- Hong Kong, Germany, and Australia showed increasing activity in crypto products, reflecting rising interest beyond the U.S. market.

During the last week of May, Ethereum positioned itself as the clear leader among digital assets by attracting $321 million in new investments, far surpassing Bitcoin, which ended with a slight net outflow of $8 million. This new capital flow brings Ethereum’s total to $1.19 billion over the past six weeks—its best run since late 2024—highlighting renewed confidence from institutional investors who are increasingly diversifying their portfolios in search of high-potential assets within the crypto space and avoiding overexposure to more volatile alternatives.

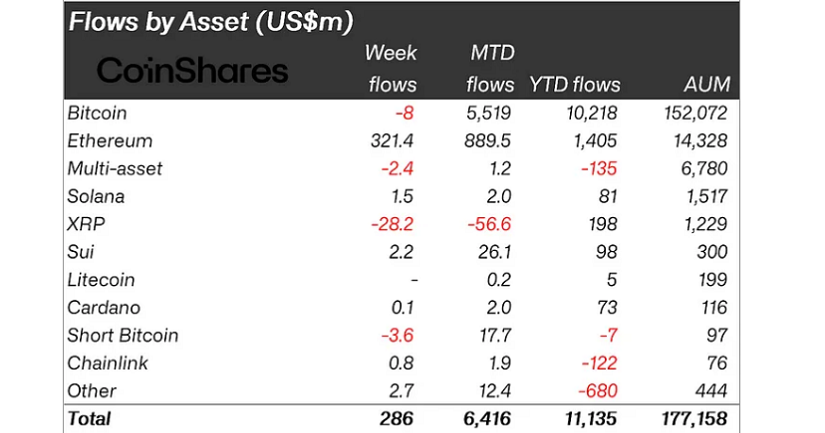

The data comes from CoinShares’ weekly report, which revealed a total inflow of $286 million during the week. However, despite the inflows, the total value of assets under management (AuM) dropped from $187 billion to $177 billion, impacted by recent market volatility partly driven by the announcement of new trade tensions between the United States and China, as well as speculative uncertainty in global financial markets.

Ethereum Establishes Itself as a Strategic Investment Safe Haven

While Ethereum continues to gain traction thanks to its technological potential and growing use in sectors such as DeFi and artificial intelligence, Bitcoin faced a temporary setback. The reversal came after statements from President Donald Trump, who accused China of violating trade agreements and reignited the tariff rhetoric. Although the U.S. PCE price index data came in as expected (2.5% year-over-year), macroeconomic uncertainty affected market confidence in crypto.

Despite this environment, Ethereum showed resilience. Its strong capital inflows suggest that large investors are betting on its long-term value beyond the current price. XRP, on the other hand, reported its second consecutive week of outflows totaling $28.2 million, reinforcing a shift in investor preference toward blockchains with stronger technological foundations and forward-looking vision.

Global Interest Reinforces Optimism in the Crypto Sector

Beyond the U.S., which accounted for $199 million in positive flows, interest diversified into emerging regions. Hong Kong surprised with $54.8 million in inflows, its best week since the launch of its exchange-traded products. Germany and Australia also posted notable figures, with $42.9 million and $21.5 million respectively, indicating that appetite for digital assets is becoming increasingly global.