TL;DR

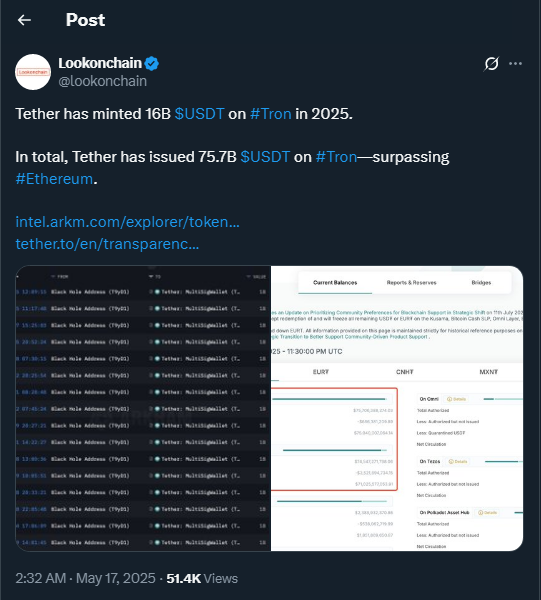

- In 2025, Tether issued $16 billion USDT on the Tron network, raising its total supply there to 75.7 billion, surpassing Ethereum for the first time.

- This move positions Tron as the leading host for global USDT transactions.

- Tether’s strategy reflects growing institutional interest and a clear goal to improve efficiency and lower transaction costs across the ecosystem.

Tether Holdings Ltd. made a bold move in 2025 by minting $16 billion in USDT on the Tron blockchain, pushing Tron ahead of Ethereum in total USDT supply. As of now, Tron hosts 75.7 billion USDT, making it the new epicenter of Tether transactions worldwide.

According to updated data from CoinMarketCap as of May 19, USDT’s market capitalization stands at $151.31 billion, with daily trading volumes exceeding $90 billion, reflecting a 64% surge in recent activity and marking one of its strongest years yet.

This expansion is far from random. Tether’s CEO, Paolo Ardoino, stated that their strategy revolves around ensuring sufficient liquidity across scalable, low-cost networks. Tron has emerged as a trusted platform with impressive speed and efficiency, key traits sought by institutional players and traders who prioritize low fees and fast execution. Additionally, there has been a noticeable increase in USDT integrations within mobile wallets and regional exchanges that focus on usability and accessibility, especially in emerging markets, further boosting global adoption and real-world use cases.

Tron Takes the Lead: Changes Across the Crypto Ecosystem

Tron’s rise as the primary USDT network brings major implications for the DeFi ecosystem. Its lower fees and quick confirmation times have attracted a wave of users who previously operated on Ethereum. Analysts from Lookonchain and Coincu suggest that this migration may ignite new opportunities within the Tron ecosystem, including growth in DeFi protocols and the emergence of more liquid trading pairs.

Moreover, this shift not only improves the user experience but also signals a broader evolution in the behavior of the crypto market. The preference for Tron shows a clear trend toward more practical and user-friendly blockchains, which may lead to a global reshaping of liquidity flows. As stablecoins like USDT continue their expansion, the focus on cross-chain interoperability and the balance between cost and efficiency will define the next stage of decentralized finance development.

Through this move, Tether not only reaffirms its leadership as a stablecoin issuer but also fuels a significant transformation in how, where, and why digital money moves across the crypto ecosystem, unlocking new avenues for decentralized innovation and financial inclusion.