TL;DR

- Coinbase closed the first quarter of 2025 with a 10% drop in revenue, hit by lower trading activity despite Bitcoin’s rally.

- The exchange finalized the $2.9 billion acquisition of Deribit.

- Its stablecoin business grew 32%, while USDC balances rose 49% in three months.

Coinbase reported a 10% revenue decline in the first quarter of 2025, dragged down by reduced trading activity even as Bitcoin neared $100,000 during that period.

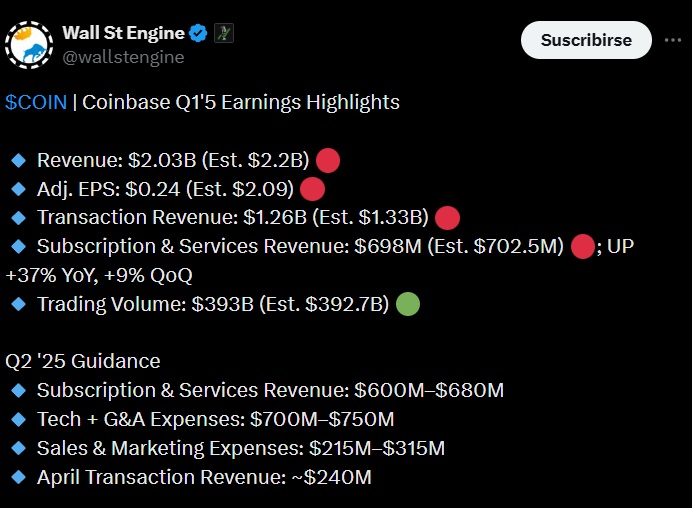

The U.S.-based exchange fell short of Wall Street forecasts, posting $2.03 billion in revenue compared to the $2.2 billion analysts had expected. Weaker participation from both retail and institutional investors significantly cut transaction volumes, a segment that has traditionally been the company’s main revenue driver.

Higher Operating Costs, Lower Revenue

At the same time, Coinbase increased its operating expenses by 51%, reaching $1.3 billion. The rise was mainly due to higher marketing expenses and accounting adjustments on digital assets held for internal use. As a result, the company reported an adjusted net income of $526.6 million, below the $679.2 million it posted in the same quarter of the previous year. Global economic uncertainty also contributed to the drop in user activity.

Not everything was negative in the quarterly report. The stablecoin business performed solidly, with revenue growing 32% compared to the previous quarter. Additionally, the average USDC balance across Coinbase’s products jumped 49%, reaching $12 billion. This growth partly offset the weakness in cryptocurrency trading operations.

Coinbase Finalized Deribit Acquisition

To counter the decline in its core business, Coinbase announced the acquisition of Deribit for $2.9 billion. The deal includes $700 million in cash and 11 million Coinbase shares. Deribit, based in Dubai, processed over $1 trillion in crypto derivatives trading volume in 2024. With this move, Coinbase will sharply strengthen its position in the derivatives market, a segment that handles much of the crypto asset volume and is shaping up to be a key source of revenue in the coming years.

The acquisition is expected to close before the end of 2025, pending regulatory approvals. The deal was made possible in part thanks to a more favorable political climate for the crypto industry in the United States, supported by the Trump administration