TL;DR

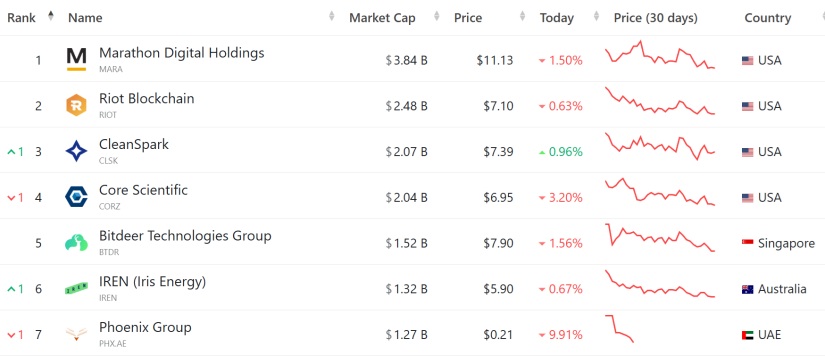

- Bitcoin mining stocks like MARA, RIOT, and CLSK dropped more than 10% due to regulatory pressure and record-level competition.

- New U.S. tariffs are driving up the cost of mining equipment imported from China, increasing operational expenses after the halving.

- Bitcoin’s computing power reached 1 ZH/s and hashprice fell to $42.40, drastically reducing profit margins.

The shares of leading Bitcoin mining companies posted sharp declines on Monday, amid a backdrop of regulatory pressure, rising costs, and unprecedented competition.

Companies such as Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) lost more than 10% in the early hours of the day, extending the downward trend observed during the previous week. Coinbase and MicroStrategy also reported similar losses during a day marked by widespread sell-offs across equity markets.

The Market Gives No Break to Miners

Rising trade tensions between the United States and China further complicated the outlook. The introduction of new tariffs by the U.S. government sparked panic and directly impacted the costs associated with Bitcoin mining hardware. Since most of this equipment comes from Chinese manufacturers, the new taxes significantly increase the operational expenses for American miners, who are already under pressure from reduced rewards following the halving.

At the same time, competition among miners reached its highest point. Bitcoin’s network computing power hit 1 zettahash per second, creating a far more demanding environment for those trying to validate blocks. This situation significantly reduced profit margins. The metric known as hashprice — which measures daily income per unit of computing power — dropped to a record low of $42.40.

Bitcoin’s Drop Hits on All Fronts

The drop in Bitcoin’s price made the situation worse. The cryptocurrency fell from over $109,000 to around $78,000 at the time of writing. This decline directly impacts miners’ revenue, who must now deal with higher costs and lower income per block.

The current landscape is highly challenging for mining companies, which are facing a combination of external pressure and internal difficulties. Growing competition, shifting trade policies, and the halving’s effects are reshaping the industry’s economic balance.