TL;DR

- Cathie Wood warns that most memecoins lack real value and will collapse due to speculation and lack of regulation.

- The $Trump token had an initial surge but then crashed, exemplifying the extreme volatility of these assets.

- Bitcoin, Ethereum, and Solana continue gaining adoption and use cases, differentiating themselves from memecoins with institutional backing and real utility.

Cathie Wood, CEO of Ark Invest, warned about the lack of value in most memecoins and their probable collapse. In an interview with Bloomberg Television, she explained that the market is flooded with tokens created through artificial intelligence and blockchain without solid fundamentals.

According to her analysis, these assets rely on speculation and, without a clear use case, will eventually lose their value. She also highlighted that the U.S. Securities and Exchange Commission (SEC) does not plan to regulate these tokens, leaving investors unprotected against potential fraud or market manipulation.

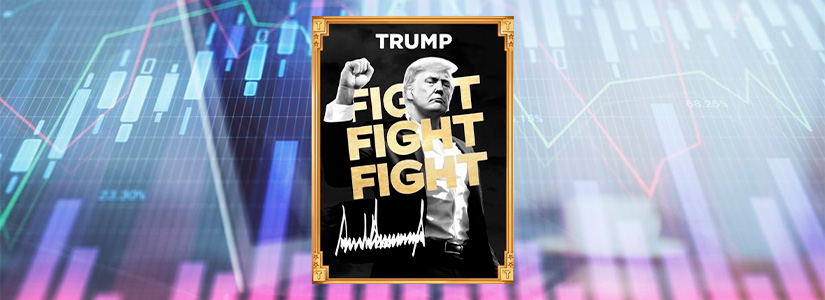

The launch of the $TRUMP token days before the former president’s inauguration triggered massive trading volume. Its price surged in the first few days but quickly lost momentum. Wood pointed out that this behavior is typical of memecoins and an example of their extreme volatility. Despite price crashes, some investors see these assets as digital collectibles. Wood does not rule out that a few might survive over time, but she believes most will quickly lose relevance.

Memecoins: Assets Without Utility or Support

Bitcoin, Ethereum, and Solana continue growing in adoption and use cases. Wood remains optimistic about BTC’s future, estimating it will surpass one million dollars by 2030. Unlike memecoins, these networks have institutional backing, a controlled supply, and concrete applications. Although Bitcoin has dropped 13% this year, it remains the most established asset in the market. Meanwhile, Ethereum and Solana continue attracting developers and projects, strengthening their position in the industry.

The memecoin ecosystem operates without regulations and carries significant risks. Many of these assets are concentrated in the hands of a few, allowing them to manipulate prices and liquidity. Fraud is common, with many cases where developers abandon the project after raising funds. The lack of audits increases the vulnerability of these tokens, leaving investors exposed to substantial financial losses.

The Controversy Behind $TRUMP

The case of the $Trump token was particularly controversial, as it is directly linked to the president’s image. Its launch on the Solana network and rapid listing on major exchanges made it stand out, but its structure raises concerns. 80% of its supply is controlled by companies tied to Trump, giving them significant control over its price and liquidity. Some interpret this as a strategy to strengthen his presence in the crypto market, while others see it as a potential conflict of interest